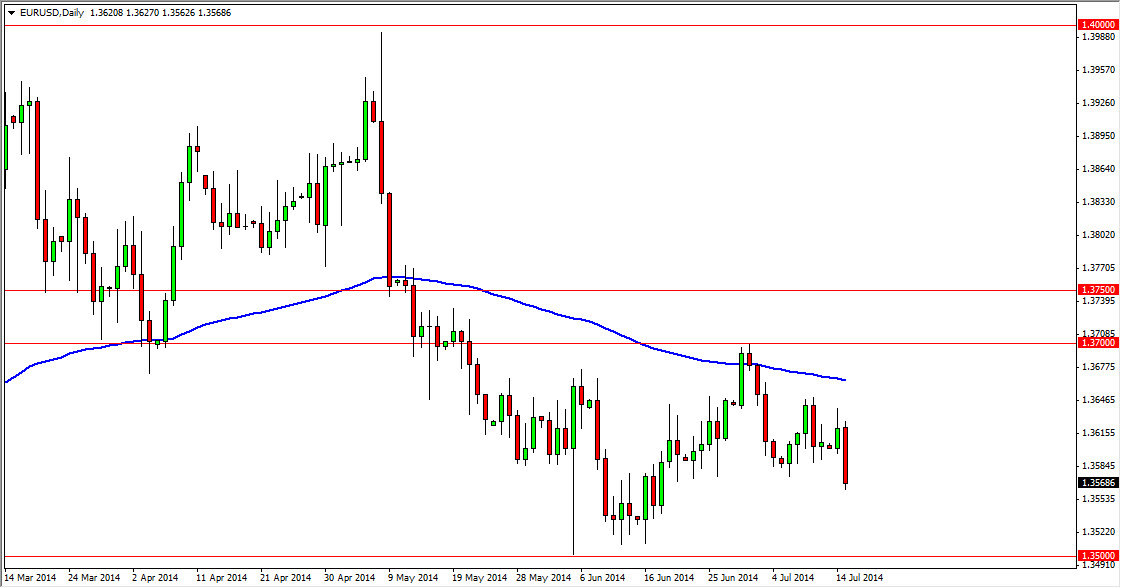

The EUR/USD pair fell hard during the session on Tuesday, but as you can see still remains in the middle of the consolidation area that we have been paying attention to for some time now. After all, I have been talking about the 1.35 level as support for what seems like ages now, as well as the 1.37 level as been massively resistant. Because of that, I feel that we are essentially in the “summer range” at this moment in time, and with that in mind I’m not really that interested in trading this pair unless we are here one of those two areas. Granted, we will finally break out of this consolidation area and one direction or the other, but I am hoping to have several wins in a row before that actually happens and stops me out.

As you can see on the chart, I have overlaid a 100 day exponential moving average, and it has acted as both dynamic support and dynamic resistance. We are starting to tilt to the downside, so I do think that this market will continue down to the 1.35 handle. It is down there that I plan on making my next trade.

Patience will be crucial when trading this market.

Patience is going to be your number one friend if you wish to make profits in this market. Quite frankly, I’m going to wait until we get to the 1.35 handle to make my next decision. Down in that general vicinity, I would not hesitate to buy a supportive candle, as it has been supportive in the past several times over. Ultimately though, if we closed well below the 1.35 handle, perhaps somewhere closer to the 1.3450 level, I would be more than willing to start selling as it would be a significant breakdown in this pair. Until then, I’m really don’t have anything to do in this market except for possibly look for Euro strength or weakness in order to trade other pairs, using this market as a tertiary indicator.