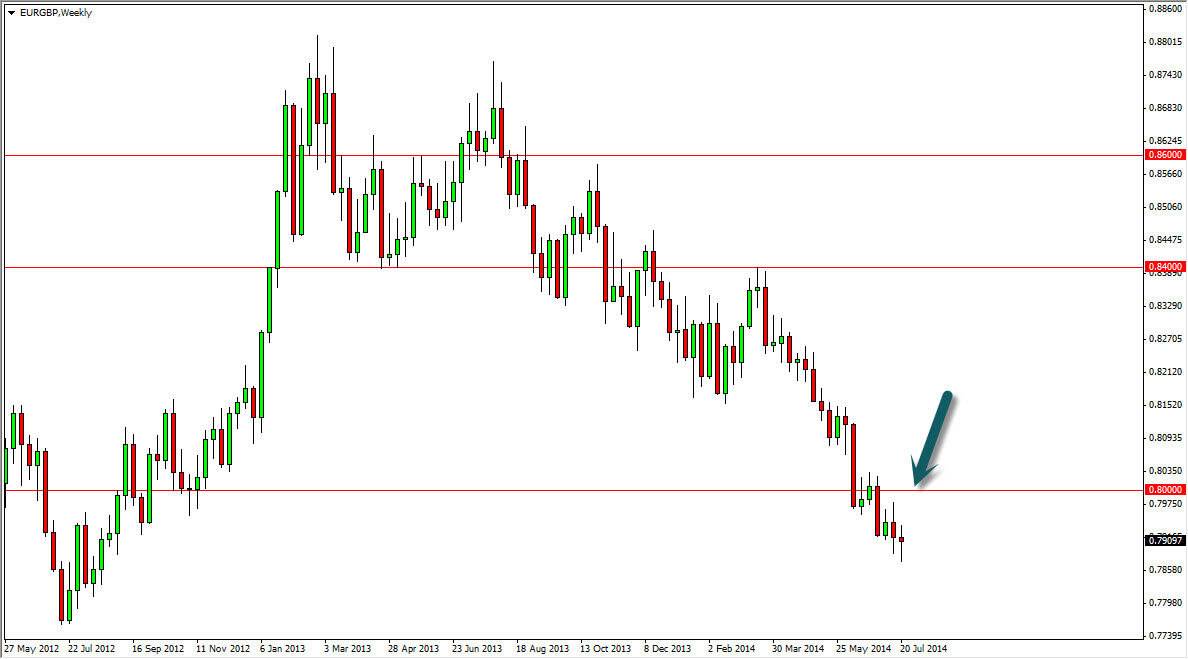

The EUR/GBP pair has been falling for some time, and the month of July certainly wasn’t any different. However, I think that August might bring a little bit of a reprieve, based upon the weekly candle that had at the end of July. It was a hammer, and it does suggest a perhaps we could see a little bit of a bounce. However, if you look at the weekly chart attached to this article, you recognize that there is a large green and down arrow roughly at the 0.80 handle. I believe that level, and the area just above it, should produce enough selling pressure to continue the downtrend going forward.

I will be selling this market at higher levels after we get the bounce. I think of that he Euro will eventually find support against the US dollar at the 1.33 level, and that should have a little bit of a “knock on effect” in this market. With that, I think the market will bounce slightly, but at this point in time there’s no doubt that we are in the downtrend. Selling with the trend will be the way to go.

Easy enough trade, it will just take patience.

This is an easy enough trade, but you can see that it will take a bit of patience. You have to let the market come to you in this scenario, and try not to get too aggressive between now and then. Yes, I recognize that sometimes it’s difficult to let the market come your level, but at the end of the day if you are waiting for that right area, it gives you a trading plan, and a list of things and scenarios that have to come true in order to actually risk your trading capital.

Once we get that bounce, I think that this market will continue downwards towards the 0.7750 region. That was the low that we had seen back in June 2012, I think we are simply at this point in time making a “round-trip” to that level. Far as buying is concerned, I would have to see this market break above the 0.150 level in order to do so, something that I don’t think it’s going to happen this month.