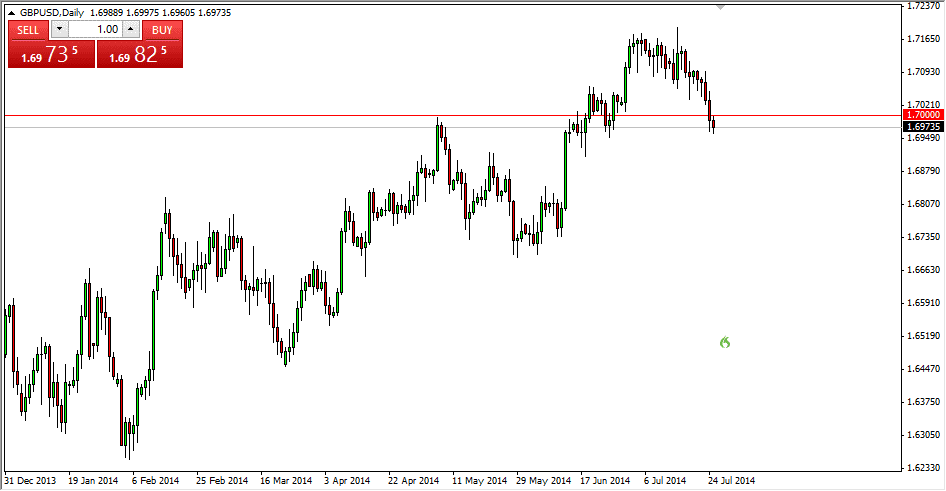

The GBP/USD pair fell during the session again on Friday, as we have cleared the 1.70 level to the downside. However, I see a significant amount is for all the way down to the 1.69 handle, and it is not until we get below there that I’m considering selling this pair. The candle itself looks a little bit like a hammer, and through some of the other brokers charts out there, it ended up being exactly that. With this, I believe that the buyers are getting ready to step back in and push the British pound higher.

On a break above the 1.70 level, I will be long of this market yet again. I believe that the market will then head to the 1.72 level where it all runs into significant resistance, but ultimately I think we go above there as well, heading towards a 1.75 level given enough time. That’s my longer-term target and has been for some time, there is nothing on this chart the changes my opinion on that.

Buying on the dips may be the way to go.

Going forward, I believe that this market will still grind and an upward direction, and as a result I think buying on dips will be the way to go, especially on short-term charts. I do believe that ultimately the British pound will continue to do fairly well, but the fact that we are pairing it against the US dollar makes it a bit choppy or than against other currencies as US dollar has a bit of a “safety aspect” to it.

However, I do recognize that if we break down below the 1.69 handle, some things may have just changed. With that, I believe that the market would then head to the 1.67 handle, and then ultimately the 1.65 Anna which of course is a large, round, psychologically significant number and therefore should attract a lot of order flow in general. Regardless though, I still believe that we go higher and feel fairly confident in the upside potential of this particular currency pair.