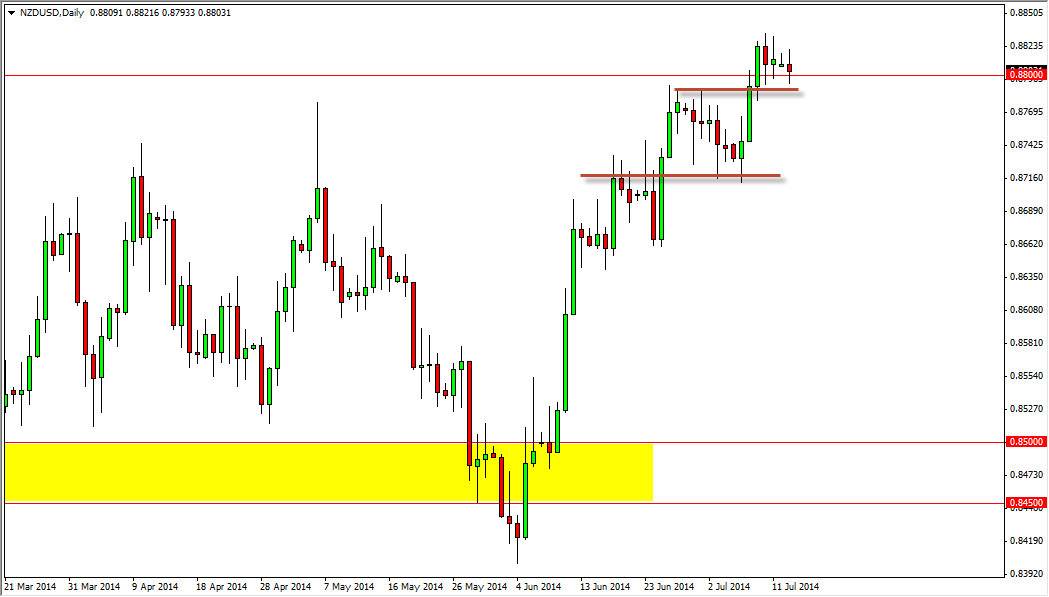

The NZD/USD pair did very little during the session on Monday as the Forex markets in general are relatively quiet. The 0.88 level continues to offer support, as it once offered such massive resistance. Because of this, I feel that the market should continue to find buyers near the 0.88 level on the short-term charts. I also believe that the New Zealand dollar is probably going to continue to go higher overall, and as a result should head to the 0.90 level, the next major significant resistance barrier above there.

However, we could pullback in this general vicinity but I see far too many support level is below to consider selling. I think the 0.88 level as obviously supportive, but so is the 0.87 level. Supportive candles at either one of those handles would be reason enough for me to buy just as much as a break above the 0.8850 level, as it would signify that the buying momentum continues to go higher.

Nice grinding trend after an impulsive move.

The market had a nice impulsive move in the beginning of June, and as a result I believe that this slow-growing higher is just simply continuation of that move, and the fact that the market continues to go higher over the longer term tells me that this is a true move, and that there is real momentum underneath. After all, the pullbacks have been very shallow, and it should continue to offer plenty of buying opportunities off the short-term charts.

The 0.90 level will more than likely offer a significant amount resistance, but ultimately I believe that it will be broken to the upside as well. A break above that level should be massively bullish, as it could send this market as high as the parity level, which of course would be an all-time high for the New Zealand dollar.

It is not until we break down below the 0.87 level that I begin to think about selling this currency. Even there, it’s going to be very difficult to sell as there is so much in the way of support, and obviously interest in going long.