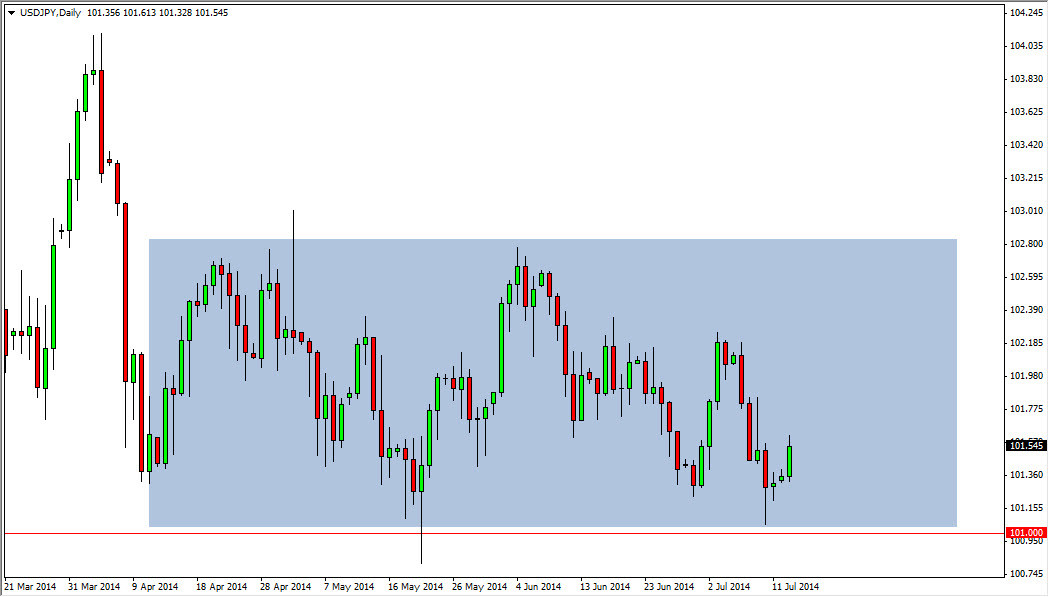

The USD/JPY pair rose during the course of the day on Monday, continuing to show that there is in fact some type of support down near the 101 level, as it has been the bottom of a larger consolidation area for some time now. In fact, one could even make an argument all the way back to the beginning of the year, and therefore means that is without a doubt a very strong consolidation area. In an area like this, and especially one that hangs on as long as this one does, there can be big money to be had.

With that being the case, I went long of this market during the session on Monday, and believe that I can more than likely counts on this pair to go to at least the 102 level, if not the 102.50 level. Ultimately, the market should be very choppy but should continue to be relatively reliable, and the positive looking candle that we form for the day on Monday suggests that the market should remain the same.

It’s the range, until it isn’t.

All things being equal, this is a range that should stay true until it doesn’t. I know that seems a bit cynical to say, but at the end of the day it’s the truth. Typically, when you buy and sell in a strong consolidation area, the idea is to get as many wins as you can. So for example, if you bought a and sell time and time again, and ultimately get four or five wins before the market finally breaks out of that range, you essentially end up in a situation where you get all of those wins before finally getting one loss. At the end of the day, that is profitable, and that’s really all you are trying to do.

Ultimately, I do believe that this market goes higher over the longer term, but at this time year it would not surprise me at all we saw three or four more months of this simple sideways market, which while most people will be avoiding, if you play it on the extremes of the consolidation area, he can be quite profitable.