USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Short Trade 1

Go long following bearish price action on the H1 time frame after the first touch of 100.88.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.18.

Remove 50% of the position as profit at 101.50 and leave the remainder of the position to ride.

USD/JPY Analysis

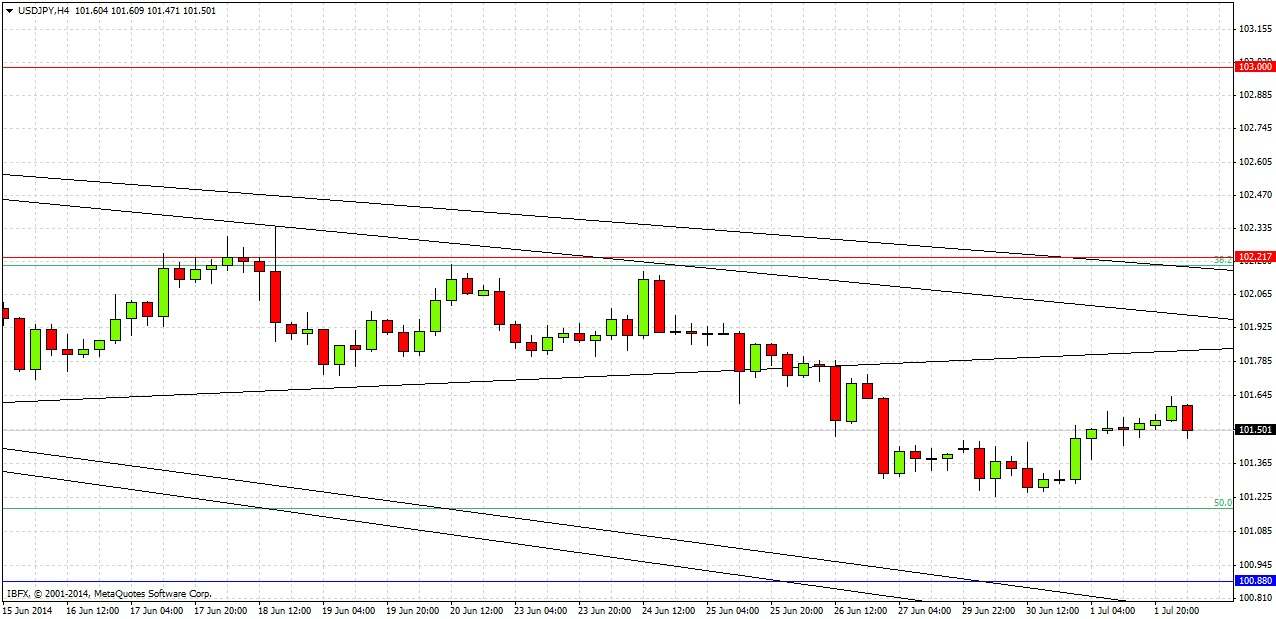

Yesterday we had a fairly small move up from the area just above the 50% Fibonacci retracement at 101.18 that has been supportive for the past several months. I had expected this might be supportive an in fact it proved to be so. However movement by this pair has been pretty congested, so trading opportunities have been few and far between. For the time being it seems this is continuing, although this might change tomorrow when there will be a very significant US data release.

It seems that the level of 101.50 is starting to be a point that flips from support to resistance. Right now it may be acting as support. Beyond that, there do not seem to be any good levels between 100.88 below and possibly the broken bullish trend line above us. However I am not looking for a short at any level before the flipped resistance at 102.21.

If we break below 101.50 this morning, we might well reach 101.18.

There are no high-impact data releases scheduled for today that can be expected to directly affect the JPY. Later at 1:15pm London time there will be a release of the ADP Non-Farm Employment Change, which may affect the USD.