USD/JPY Signal Update

Yesterday’s signal expired without being triggered.

Today’s USD/JPY Signal

Entries may only be made between 2pm and 10pm London time today, and then during the following Tokyo session.

Long Trade 1

Go long following bullish price action on the H1 time frame after the first touch of 100.88.

Put a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 101.18.

Remove 50% of the position as profit at 101.50 and leave the remainder of the position to ride.

Short Trade 1

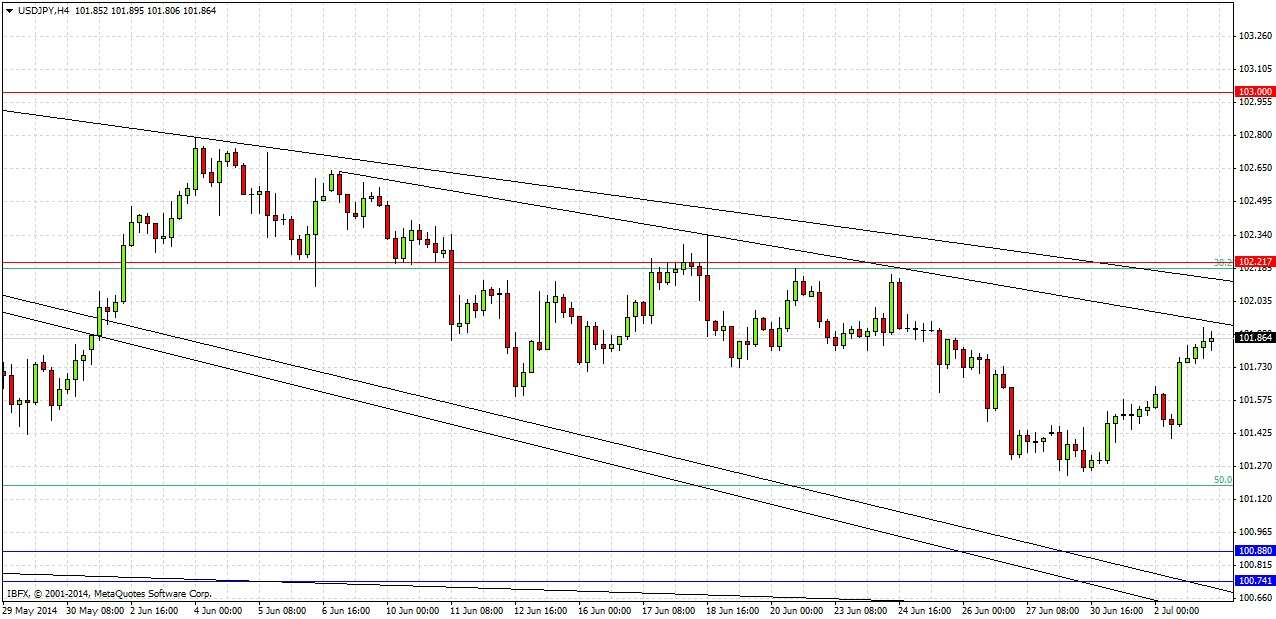

Go short following bearish price action on the H1 time frame after the first touch of 102.21, provided the price action is also rejecting the nearby bearish trend line.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches the broken bearish inner trend line.

Remove 50% of the position as profit at 101.65 and leave the remainder of the position to ride.

USD/JPY Analysis

Although we did break 101.50 yesterday, the price turned up abruptly with the better than expected USD news, and this pair’s bullishness continued overnight. We are now threatening to retest the bearish inner trend line which is not far away.

There is no point trading this pair before the big US news releases begin shortly after the New York session starts. The bearish inner trend line is too close to be useful at that time, but there is a nice confluence of an outer bearish trend line, a key Fibonacci level, and a flipped support to resistance level at 102.21. I will be looking for a short trade there if a reversal is suggested by bearish price action.

There is strong support quite a distance below starting at around 100.88. If the news causes us to spike down there we might see a bullish reversal at that level.

There are no high-impact news releases due today that will directly affect the JPY. Concerning the USD, we will see releases today of the US Non-Farm Employment Change, Unemployment Rate, Unemployment Claims, and Trade Balance data at 1pm London time. Then at 3pm there will be the US ISM Non-Manufacturing PMI. It is likely that from the time of the US data releases, the pair will be extremely volatile.