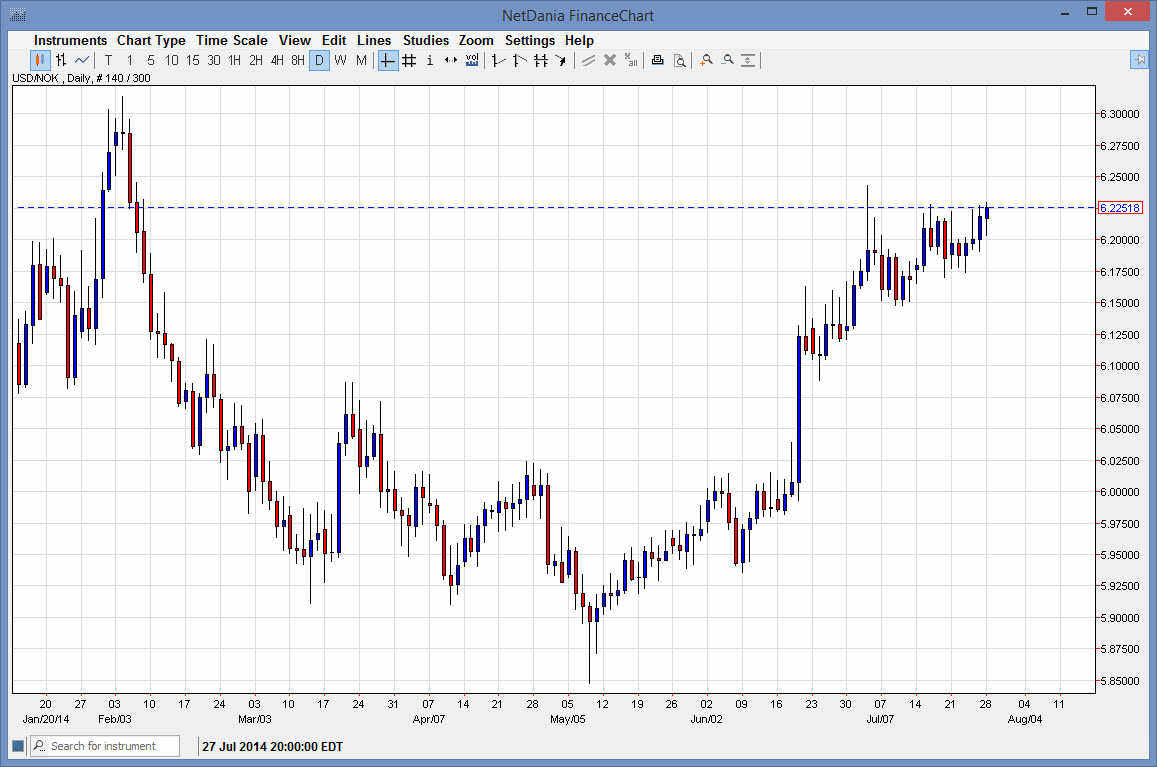

The USD/NOK pair initially fell during the course of the day on Monday, but as you can see the 6.20000 level cost enough support for the market to bounce and form a nice-looking hammer. That being the case, the hammer suggests to me that we are going to see buyers step back into this marketplace, and continue to buy the US dollar. The Norwegian krone is highly influenced by the oil markets, and it must be said that the oil markets are a bit dicey at the moment.

This is going to be especially interesting now that the Forex markets seem to be coming to grips with the idea that the Americans have the ability to produce their own oil. Quite frankly, some of the old oil and currency correlations are starting to break down, which is most often seen in the USD/CAD pair. It used to be that the pair would fall as oil went higher and vice versa. However, the Americans are starting to produce enough of their own petroleum that the correlation seems to be dying, as the Canadian dollar has been in a downtrend, meaning that the pair has been going higher, for the last two years, while oil markets seem to have had very little impact.

The Norwegian krone however, is going to be quite a bit different.

Quite frankly, currency traders don’t get involved in the Norwegian krone for any other reason than to express their opinion on oil. After all, it is a very small economy. Yes, Norway is a very modern and well developed country, but at the end of the day demand for the Norwegian krone isn’t exactly high in comparison to other currencies such as the Euro, or perhaps the Japanese yen. That being the case, this is a little bit more reliable type of trade it seems. This pair tends to trend for very long periods of time, and as a result this can be a nice investment quite frankly. I think that a break above the top of the shooting star from two or three weeks ago send this market looking for the 6.30000 level, and then much higher levels.