USD/CAD

The USD/CAD pair initially fell during the course of the week, but as you can see we managed to break higher, clearing the 108 level at the end of the week. Not only that, we managed to break the top of the shooting started formed at that level, so I think that this is the real thing, a significant breakout as we continue the uptrend from August 2012. With that, we feel that the market will ultimately grind higher, and we have had a decent enough pullback to give this move some legs. With that being the case, I went long of this on Friday.

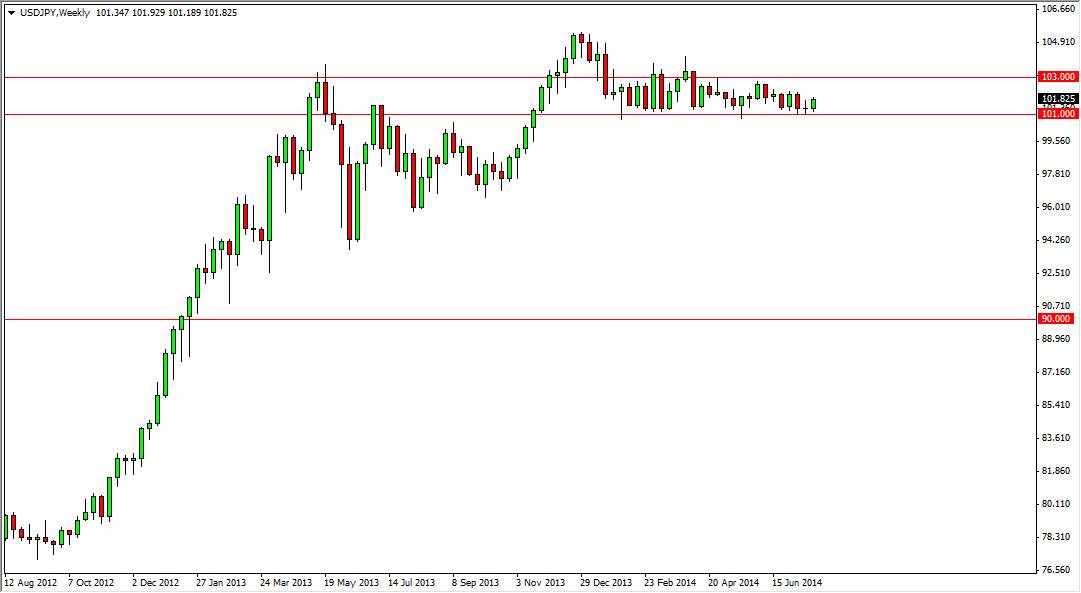

USD/JPY

The USD/JPY pair rose during the course of the week, using the 101 level as support. We have been stuck between 101 and 103 for some time now, so quite frankly this is essentially what I look at as “dead money.” That isn’t to say that I don’t have a bias, it most certainly is to the upside, but until we break out above the 103 level I am on the sidelines as far as longer-term trades are concerned. With it being in summertime now, it would not surprise me at all if it took some time before it broke out.

GBP/USD

The GBP/USD pair fell during the course of the week, breaking below the 1.70 level. That being the case, the market looks as if it’s going to continue to pull back slightly, but I think ultimately we will find significant buying pressure just below. I am waiting for supportive candle in order to go long, because I believe that the British pound is fairly strong. With that, I think we would return to the 1.72 level, and then ultimately the 1.75 handle. Have no interest in selling this market until we get below the 1.67 level, which is that point in time I believe that we would have seen a bit of a momentum shift.

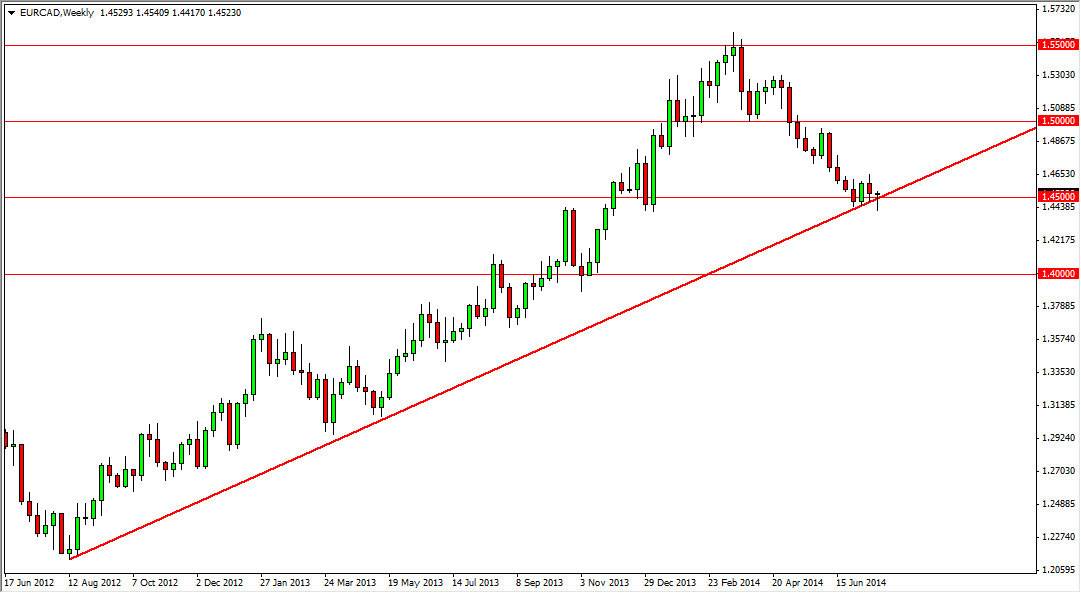

EUR/CAD

The EUR/CAD pair fell below the 1.45 handle during the week, but as you can see we bounced back above the trend line, and formed a hammer. Is because of this that I believe this market may continue to go much higher, as it is essentially a mirror image of the USD/CAD pair. With this, I break of the hammer, I believe that the risk reward ratio is too good to pass up, and then going long is the only thing we can deal. Ultimately, I would not be surprise at all to see this market go to the 1.55 level.