The sharp decline of Bitcoin continues with the current price is $511.50, down 6.83% over the past 24 hours. Bitcoin has been on a strong downward trend for the past month and this could be due to large merchants such as Dell and Expedia immediately selling their Bitcoins to receive the correct amount in USD. Two top Circle executives have stated strong critiques of the planned regulation for Bitcoin in New York. The CEO of Circle, a Boston-based Bitcoin start-up, stated that the company would block New York customers from using its services if the BitLicense proposal became law. This marks the first time a Bitcoin company has explicitly and publicly stated that services will not be provided to New York customers because of the proposed regulatory framework. The argument against the regulation proposal in New York is that the top-down approach puts developers at a significant disadvantage and regulators should focus on the finance, rather than the infrastructure and software, side of the Bitcoin economy.

Elsewhere, BitAccess is aiming to build a network of Bitcoin ATMs worldwide. This concept is not new, however BitAccess provides an easy-to-use interface, a broad vision of how new hardware can be used and is the only provider manufacturing its own transaction hardware. All that is needed is a mobile phone number and some money to get a Bitcoin.

Overstock Inc.’s sales through Bitcoin have exceeded $2 million so far since it started accepting Bitcoin payments in January. By the end of the year, Overstock expects to complete $1 million in Bitcoin sales per month. Overstock also plans to accept Bitcoin payments from international customers by September.

Peer-to-peer lending platform Bitbond has received venture capitalist funding to boost its global growth. Bitbond is based in Berlin and plans to use the capital investment to build a team of programmers improve the platforms functions and increase its marketing activities. This indicates a growing interest of venture capitalists in virtual currencies.

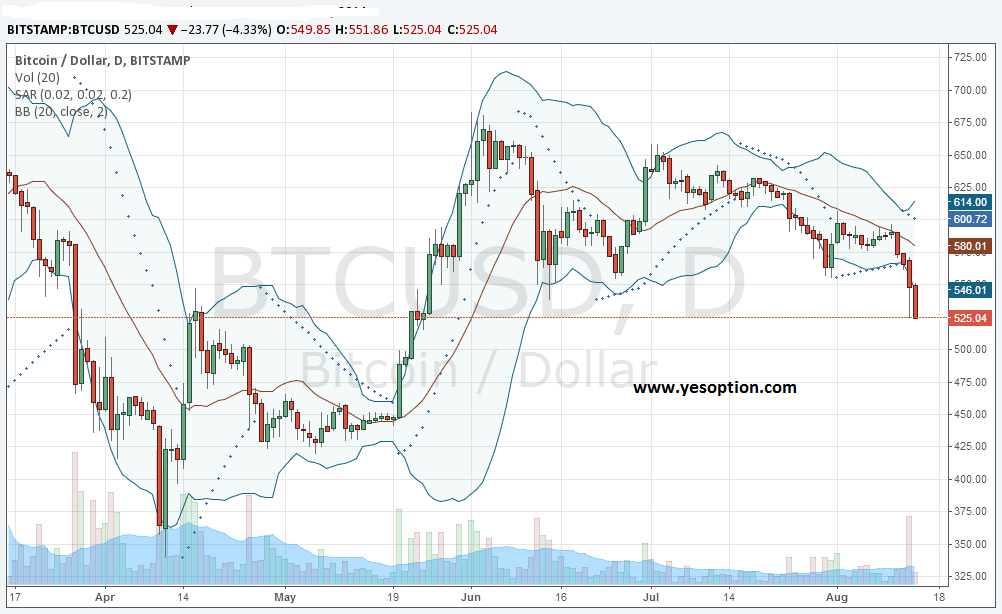

From the daily chart, we can see that the Bollinger bands ‘squeezed’ together on the 12th August and the price seems to be exploding to the downside. Further downward moves should happen today, as the Parabolic stop and reversal indicates an upward trend has not started yet. Also, using the Ichimoku cloud, shown in the chart below, we see that the price action is below the cloud indicating a downward trend. However, the green line is not falling and is above the red line, indicating the downward trend is not that strong at the moment. The conversion line, i.e. the blue line is below the base line (dark red line), which indicates bearish price momentum, also indicated by the price action being below the base line.