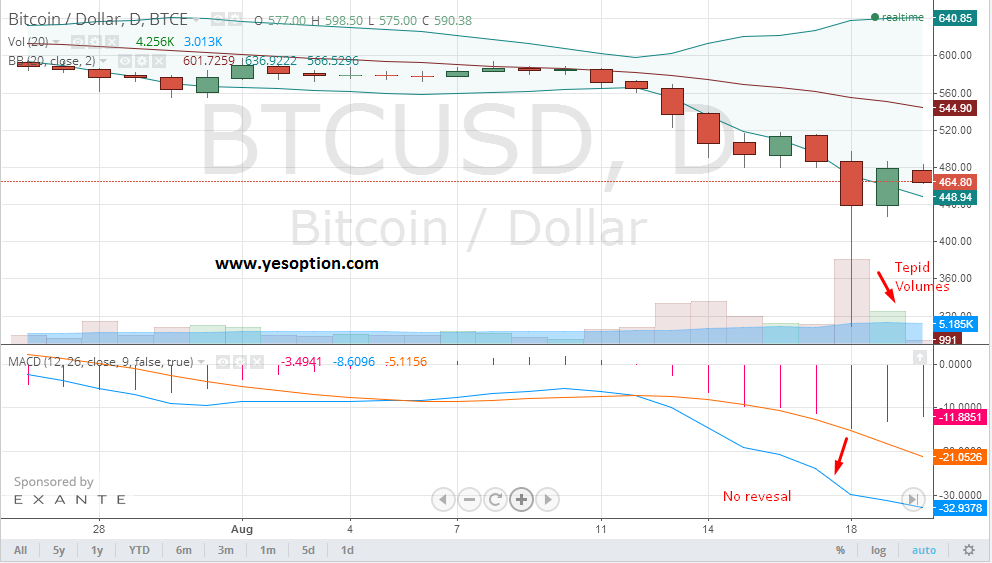

BTC/USD showed a strong pull back post the panic sell off it witnessed the day before yesterday when the digital currency hit intraday lows of $310 on the back of high volumes and panic sells. Many traders believe that the pull back seen yesterday was just a short covering rally and not a sign of a reversal for the BTC/USD. The rally seen yesterday was on tepid a volume which is a clear indicator of it being a profit taking rally. The momentum indicators for the BTC/USD have shown no signs of a reversal and even the rally seen yesterday wasn’t able to shift the control from the bears to the bulls. Traders are of the opinion that every rally in BTC/USD should be used as a selling opportunity by investors and traders as momentum has clearly shifted towards the downside.

Actionable Insight:

Short BTC/USD at current levels for a target o $380 with a stop loss at $500

The new cryptocurrency QiBuck, which is slated to launch soon in August has something different and interesting to offer to its holders, which is in the form of passive income. The adopters of QBK will benefit from its feature of Proof of Bagholding (PoBH) as holders of over 100 QBK will not just receive bonuses, but also a share of profit from the investments of QBK team.

While QBK is already preparing for a strong starting point, Stripe, an online payments firm, has won the support from Rupert Murdoch. Stripe was founded by Patrick and John Collison and the firm has recently invested €2.2m in Stellar, a rival currency to Bitcoin. Murdoch tweeted, "Mixed successes ahead, but Stripe, by brilliant Collison brothers outstanding." A feature that separates Stellar from Bitcoin is its ability to support arbitrary currencies, like euros, dollars and even bitcoins. Stellar is created to find out how efficiently money can be moved and the concept is gaining traction as more than 500,000 people have already signed up to get the new currency in its first two weeks of launch.

Bitcoin rivals are progressing, but Bitcoin and other digital currency tax payers can now sigh a breath of relief. Libra Services has launched software, called Libra Tax to take care of digital currency taxations in accordance with the guidelines released by the Internal Revenue Services. The software could retrieve a user’s transaction history and adjusts it with the historical fair market value of the digital currency. Moreover, the software is easy to use as it could accommodate all types of taxable events, like gifts and donations, a service that can witness large acceptance among the digital currency adapters.