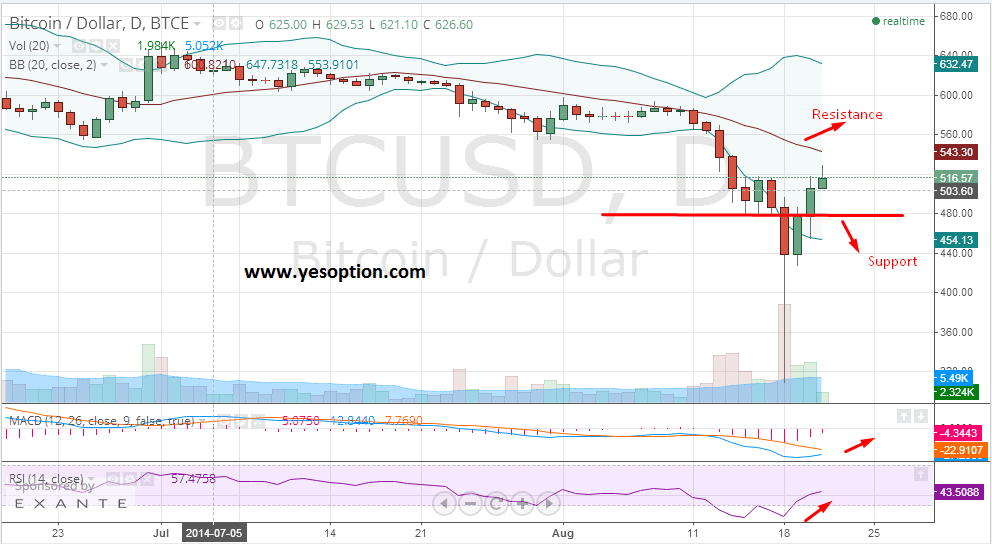

The Bitcoin bulls breathed a sigh of relief as they witnessed follow up buying emerge yesterday which confirmed that there were buyers available at lower levels. BTC/USD had witnessed a panic sell off a couple of days ago which had seen prices plummet to levels of $310 in intraday trade but bounce back from the lows after buying emerged at lower levels. Many traders feared that if follow up would not have taken place in yesterday’s trade the downtrend would have continued and prices would have headed lower. For traders, the next level of resistance for BTC/USD will be around 20 day exponential moving average currently at $543 and a close above that would be a huge boost in near term direction for the digital currency. The momentum indicators for the BTC/USD are both showing first signs of a reversal and therefore traders would be closely watching the resistance zone at $543

The one thing that bitcoin industry lacks is a proper flow of communication as there has been several cases when the information released resulted in confusion and led to overreaction. Thus, in order to ensure smooth flow of communication, Crypto Events is organizing Bitcoin Expo 2014 in Shanghai next month. Through this platform the company aims to bring the local key players in China and worldwide closer to western Bitcoin influencers, so that they have a chance to explore the future opportunities in the crypto currency.

At the same time, Chain, another start-up, has secured $9.5 million of funding in an investment round headed by Khosla Ventures. With the new fund injection, Chain has now $13.7 million of investment money in its account. Chain's objective is to aid developers create applications around Bitcoin. The start-up's co-founder Adam Ludwin said that their company is excited to play a central role in financial innovation brought by the Bitcoin.

On the contrary to Chain's vision, Australian Taxation Office (ATO) has set a different tone as the regulatory body has released its anticipated guidance and said that it will not consider Bitcoin equivalent to cash and so, its transactions will be taxed like a non-cash barter system. The decision of ATO has dampened the hopes of Bitcoin players in Australia, as they fear that the growth of the virtual currency in their country would be restricted to offshore or underground activities.