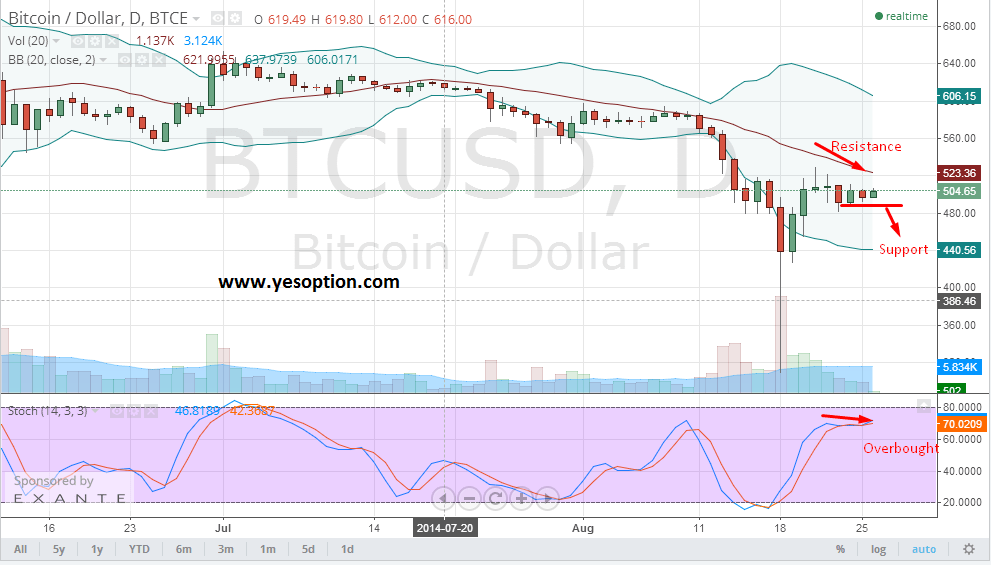

BTC/USD had a very flat session yesterday with prices moving in a very narrow trading range over the course of the day. The digital currency has over the last couple of days formed a strong base around the $490 level and seems to be taking support post the panic sell-off it witnessed at the far end of last week. On the upside, the resistance for the BTC/USD still persists around levels of $523 which is also the 20 day exponential moving average. The stochastic oscillator for the BTC/USD is currently trending in the overbought zone and is on the verge of providing a sell signal and therefore traders who are long on the BTC/USD should follow a strict stop loss.

Actionable Insight:

Short BTC/USD if it falls below $481 with a strict stop loss at $502 for a near term target at $458

Long BTC/USD only if it climbs above $523 with a stop loss at $500 and a target at $561

Korean Bitcoin Exchange Korbit has announced that it has successfully raised $3 million in its Series A funding, where the main contributors to the funding were SoftBank Ventures Korea, Pantera Capital, BAM Ventures, Strong Ventures and Bitcoin Opportunity Corp. Korbit said that it will utilize the funding to scale up its products and services and to make additional hires. Korbit has 25,000 exchange users and 400 merchant accounts, it offers services similar to Bitpay and Coinbase but is highly localized in accordance with the Korean market.

Back in the United States, Manhattan has housed first kind of ATM machine, which will take in cash to convert in Bitcoin. However, bitcoin conversions into cash are not available, but Bitcoin enthusiasts are considering the development as another milestone in the virtual currency world. One of the interesting feature of this ATM is that it will give Bitcoin access to those who are shying away from online exchange and do not want to maintain traditional bank account. However, people who have more preference for cash would take time to settle with the new development.

On the other hand, the bitcoin users might not be happy to learn that Cannabis Road, which is an online marketplace for buying cannabis products in exchange of Bitcoin has gone offline, following an attack from the hackers. The website's lead developer Crypto confirmed that 200 BTC or approximately $100,355 worth of bitcoins was stolen, doubting if the project could continue further for the lack of funds. The hackers were able to breach the system even after the Cannabis Road had recently employed three levels of securityin a bid to protect against hacking attempts.