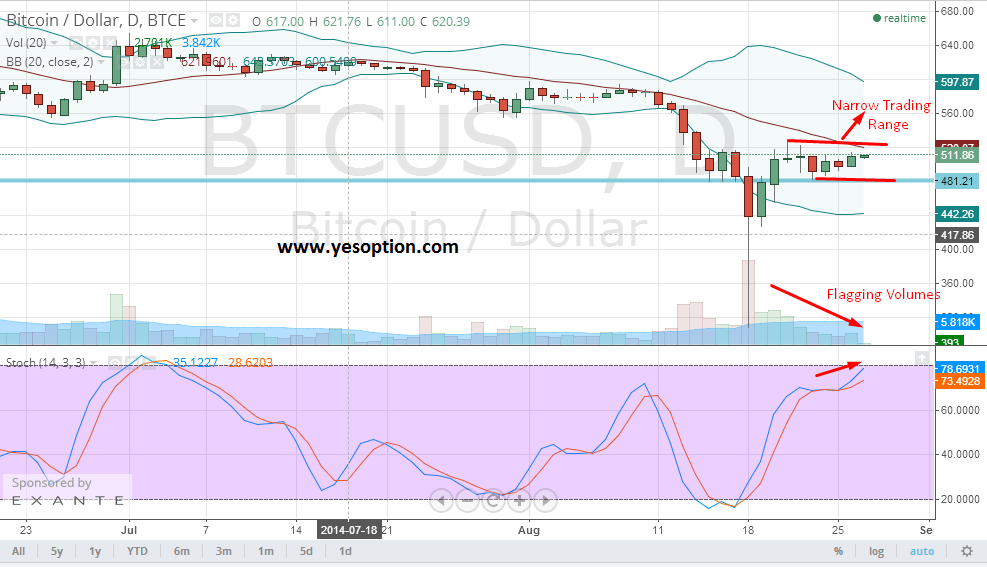

BTCUSD had a relatively flat session yesterday on the back of low volumes as traders and investors wait for a trigger to understand next direction for the digital currency. On the charts, the BTC/USD has formed a very good support at $481 and it is unable to break above the resistance zone of $521 and any attempt to go closer has been met with selling pressure which is a cause of concern for the traders and investors. The stochastic oscillator for the BTC/USD is currently trending higher and showing no signs of a reversal which shows the momentum firmly being in the hands of the bulls who are lending buying support to the BTC/USD at lower levels.

Actionable Insight:

Long BTC/USD only if it closes above $521 with a target at $550 and a stop loss below $502

Short BTC/USD if it closes below $481 with a target at $432 and stop loss above $503

The giant research house, Citi, has explained that the oversupply of bitcoins coupled with sluggish demand is the main cause of excessive instability in the Bitcoin prices. The company mentioned in its report that miners and large merchants are mining 3,500 BTC on a daily basis against a daily trading volume of 60,000- 10,000 BTC, while the quick conversion of bitcoins into fiat currencies by large merchants like Dell and Expedia further push the prices down. Citi supported the move by these companies as it said that accounting practices do not count Bitcoin as an asset rather as speculative positions, which increases the risk of the companies and they have no option left but to convert it into traditional currency.

Back in Australia, the government has dedicated a page under business section on its official website 'business.gov.au' to clarify the tax obligations and other general Q&A related to governance of Bitcoin in the country. The website also calls for the feedback from business owners to help shape the virtual currency future, but it lacks information on other guidelines like banking status of these currencies and anti-money laundering, which were more closely looked for.

On the other side, amid increasing debate on how Bitcoin value should be expressed, Sweden based, KnCMiner, a Bitcoin based mining company has chosen to let its users view Bitcoin prices in bits. Some of the adopters are contemplating on using smaller units like microbits, millibits or satoshis, while others opine that a simple and comprehensible value should be the choice, which could make it easily to adopt.