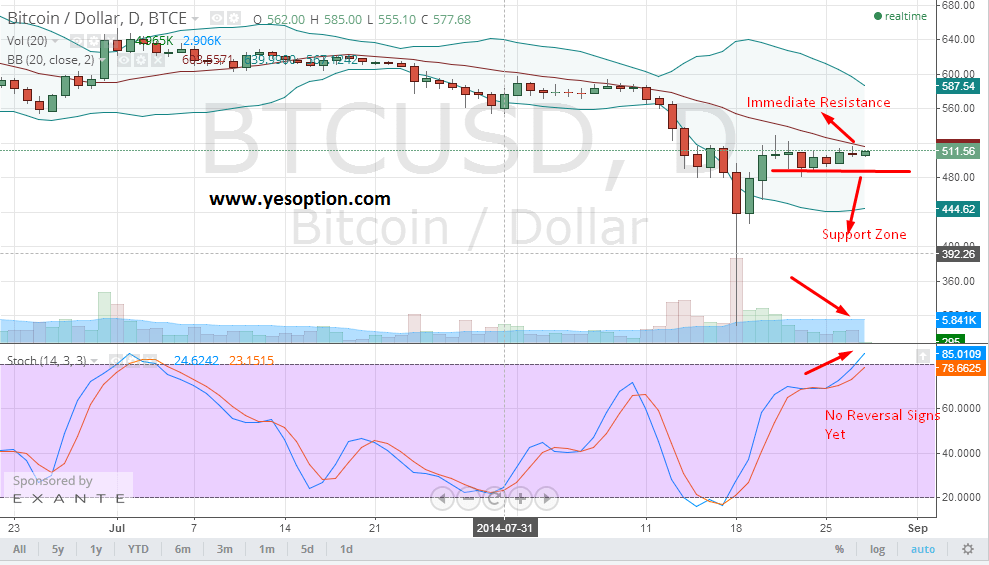

BTC/USD had a flat session in yesterday’s trading session trading in a very tight range. The digital currency over the last couple of trading sessions had taken very strong support at $481 and continued to hold onto the support which is being seen as a huge positive by traders in the near term. The digital currency is unable to move above the resistance zone at $516, which is being closely watched by traders, and investors as any upmove in the digital currency would occur only if it closes above this level. The stochastic oscillators for the BTC/USD has entered into the overbought zone but are currently showing no signs of a reversal, at the same time traders should maintain strict stop losses as the lack of buying at higher levels is a cause of concern.

Actionable Insight:

Long BTC/USD only if it closes above $517 for an intermediate target of $540 with a strict stop loss at around $498.

In the last week, Australia's regulatory body ATO had released taxation guidelines with respect to Bitcoin. The guidelines elucidated applicability of taxes on Bitcoin under various circumstances, which could be considered as a broad approach in line with other nations. However, the taxation rules remained ambiguous about the tax evasion and money laundering aspects, which came in contrast to the expectations of the general public. Different countries have adopted different taxation rules for the virtual currency to suit their individual economies, however, the global presence of the Bitcoin makes it difficult to arrive at a decision as to which country has right to fix the global taxation policy for Bitcoin.

Meanwhile, Grand Rapids embraced to the Bitcoin with a new ATM installed at its downtown Skywalk Deli. The ATM machine converts the cash into Bitcoin and a person having a Bitcoin account could exchange money with other users across the globe.

Despite the evolution of the virtual currency, 65% of consumers would not buy Bitcoin theory, according to a report published by Massachusetts Division of Banks (MDB) in association with the Conference of State Bank Supervisors (CSBS). The two bodies collected responses from over 1,000 consumers through an online survey, and the results indicated that though 51% of the respondents were aware of the digital currency, a very low ratio of them actually thought of dabbling into it. Survey further revealed that the vulnerability to risks and age demographics played majorly in affecting emotions of the survey takers.