By: Ben Myers

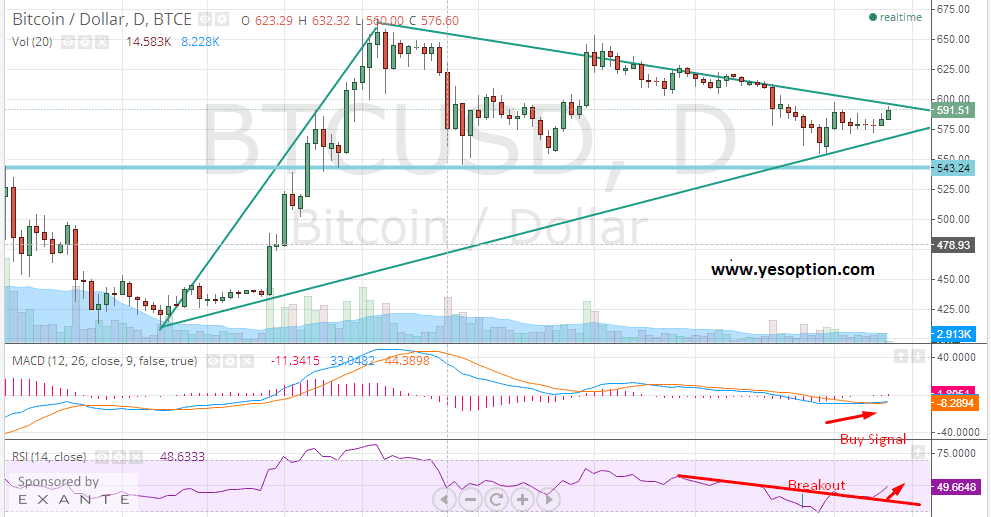

BTC/USD on the hourly charts has shown some momentum on the upside. It has resistance at $595 which is downward sloping trend line. If BTC/USD is able to break above this level of resistance on back of good volumes then it can see a push towards $623 in short term. The momentum indicator for the BTC/USD has given a fresh buy signal which is in line with the bullish stance. The relative strength index has given a fresh breakout above the resistance zone which was a downward sloping trend line and confirms the buy side momentum

Traders who are long on the digital currency should keep a stop loss of $552 for target of $623 in short term.

Bitcoin wallet makers, KryptoKit have come up with an innovative and unique method, RushWallet, to help users send and receive bitcoins on the go. The new wallet differentiates itself from others in a way that it does not need login credentials, but users create their wallet by getting a onetime secret URL. Kryptokit claims that the wallet is created to prevent hacking or any security breach, but users would need to keep their URL safe, which if lost will be as good as losing the wallet.

Like easy wallets, Coinsafe is also trying to pitch easy Bitcoin ATMs to merchants through mobile. A merchant would need to register itself for Coinsafe account along with mobile app linked to BitStamp, Blockchain or Coinbase. The arrangement will first of all, let merchants offer bitcoins to walk-in customers in exchange of cash, and secondly it will allow merchants to get control of the spread between the buying and selling sides. On the other hand, the facility will become alternative to Local Bitcoins for individual users.

These developments have not only raised the Bitcoin stature against traditional currencies but have also helped it reach the developing nations. A Forbes report cites a number of ways in which Bitcoin is serving the developing countries in their routine affairs. Mainly start-ups are actively involved in creating a foundation for the digital currency through forming platforms like wallets, exchanges and other services. On a single day, the bitcoin transactions account to 65,000 with 13 million of it in circulation globally. While the consumer confidence in these nations are of critical importance to drive Bitcoin's future growth, more than 50% of Asians and Africans seemingly like the concept, as disclosed in a survey report.