By: Ben Myers

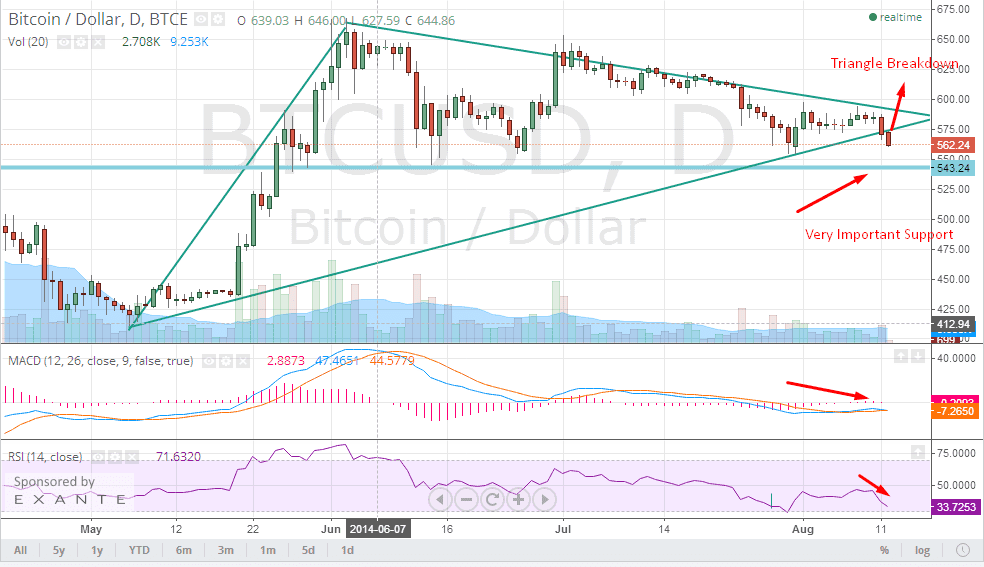

BTC/USD on the daily charts broke below the lower end of the triangle formation which is seen as a bearish sign on the back of good volumes. Post the breakdown we see the next level of support for the digital currency at around $543. If the support level is broken we can see the BTC/USD swiftly move towards levels of $490 in the very near term. The momentum indicator and the relative strength index for the BTC/USD have given a fresh sell signal on the back of the price action seen on the daily charts.

Traders should keep a very close eye on the $543 level if they are long BTC/USD as any breach can be followed by a swift sell off.

Actionable Insight:

Long BTC/USD above $596 with a stop loss of $542 for a target of $624

Short BTC/USD below $540 with a stop loss of $568 for a target of $498

Researchers of Dell SecureWorks, a cyber security firm, have identified theft of Bitcoins of more than US $83,000 by a Canadian based hacker. Further, the firm has disclosed details that the hacker breached into the networks of foreign firms like Amazon and OVH, which have servers to generate Bitcoins and redirected activity. In addition to this, Dell SecureWorks suspected that the hacker did the task alone while serving as an employee at the ISP, the name of which has not been specified.

Such scams have resulted in a new warning being issued by the Consumer Financial Protection Bureau, which has advised the consumers about the potential risks associated with the virtual currencies. The Bureau said that looking at the increased potential of the virtual currencies to attract consumers to the scams and other threats as well as lack of regulatory framework; it has decided to start accepting complaints of such issues or related companies.

However, Payza, a global online payment processor is unmoved with those warnings as the company revealed that it will allow customers to buy bitcoin through a bank transfer across 190 countries. Through this offering, Payza is finding new opportunity available in the bitcoin's merchant space, according to the company’s business development consultant Charlie Shrem. Payza's platform will offer multiple payment methods to its merchants, which is not present with other Bitcoin service providers like BitPay and Coinbase.