By: Ben Myers

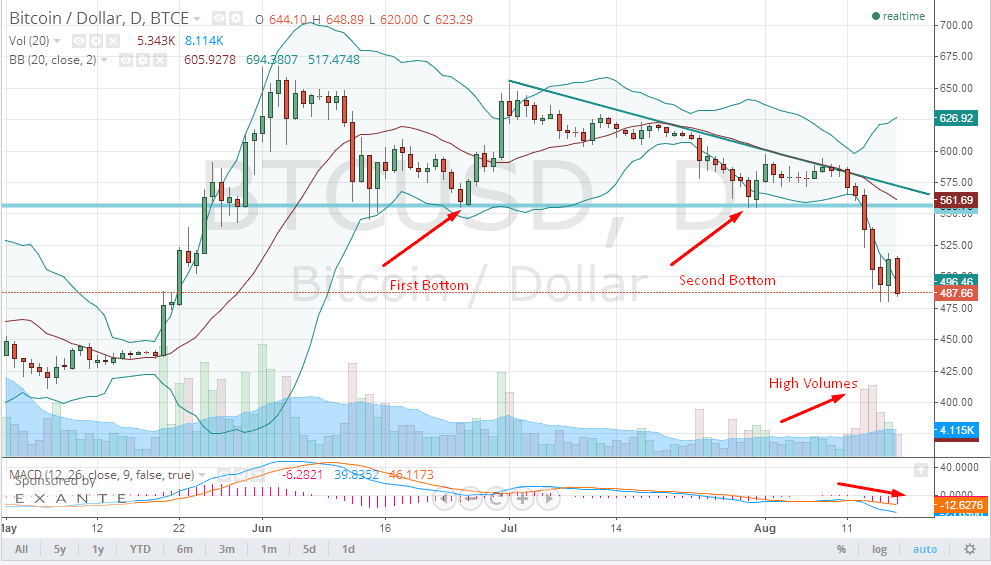

BTC/USD on the daily charts has been in a very strong downtrend right from the time it has broken below the important support level at $556. The digital currency had formed a double bottom on two previous occasions at that level but could not hold onto the support and therefore has witnessed a huge sell off. This according to many technical chartists is the formation of a triple top which is a bearish formation. Fridays’ price action saw the formation of a bearish engulfing pattern and took away all of the gains that were seen on Thursday. The momentum indicator for the BTC/USD has given a sell signal indicating that momentum currently lies in the hands of the bears, at least for traders with a near term perspective.

Actionable Insight:

Short the BTC/USD at current levels with a strict stop loss at $523 with an intermediate target at $462 in the very near term.

The Bitcoin prices are dropping again as they fell sharply by $100 to $497 over the last one week, while its downward trajectory remains more or less unexplained as the industry is flooded with a series of mixed news. The latest development is that there is some relief to the Mt. Gox creditors after the U.S. officials said that they are cooperating with authorities in Japan with their investigation to resolve the hacking scam that led to the collapse of Mt. Gox. Creditors have been allowed a further extension of six-months to register their claims in the case, which means that the investigations will not conclude for another six-month, battering hopes of the creditors for an early resolution.

On the other side, Fold, which is known for Coin For Coffee and Card For Coin, had rolled out a new app that would allow the users to make payment across a range of point-of-sale (POS) systems. Payment through the app will be processed through scanning barcodes, which replicates the Fold's earlier products’ features.

Lastly, following the footsteps of other nations, India too has started creating ripples in the Bitcoin industry. In a first ever public announcement, Unocoin, one of the country’s Bitcoin based company has recently amassed $250,000 investment from Bitcoin Opportunity Corp, which is founded by Barry Silbert. Both Unocoin and Silbert are confident that their investment will generate massive returns over time as they are confident to tap into the world's largest unbanked population.