By: Ben Myers

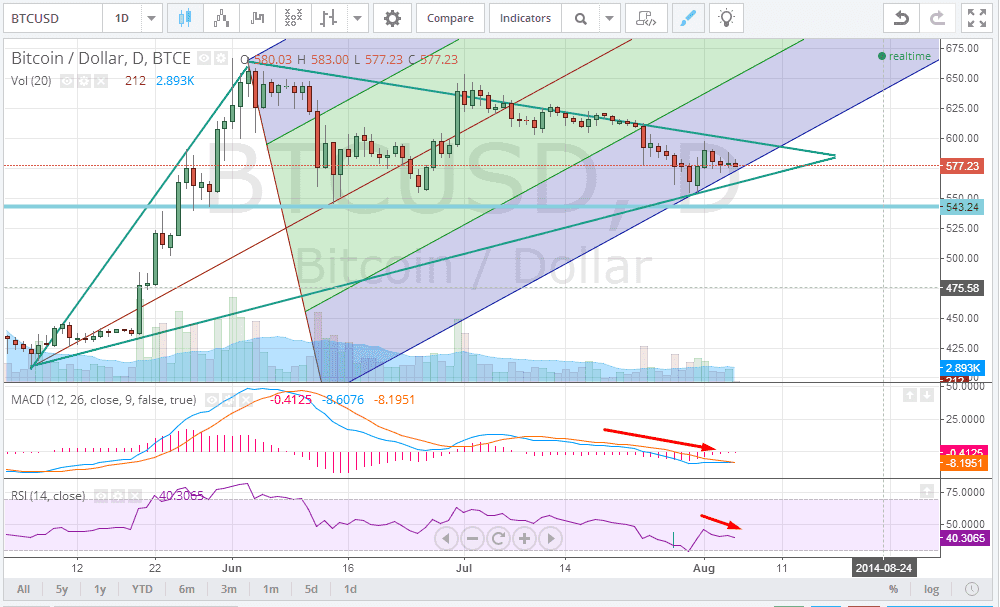

BTC/USD on the hourly charts has been trading in a very narrow trading range forming a triangle. Prices have been unable to break above or below the support and resistance zones. As per Andrews Pitchfork, BTC/USD has very good support at levels of $543 whereas the resistance for the BTC/USD comes at around $610 which is also the downward sloping trend line and also the upper band range of the triangle. The momentum indicator for the BTC/USD has been in a downward momentum proving that every bounce from lower levels has been sold into by traders. The relative strength index for the BTC/USD has formed a lower high which is a bearish sign.

For long traders the support level should come at around $562 which if broken can see the digital currency fall to levels of $525 in the near term. Short traders should keep a strict stop loss at levels of $612; any break above this level can see the BTC/USD rally to levels of $660 in the very near term.

The latest example of how Bitcoin is steadily clearing the doubts about its future is set by Josh Garza of a mining equipment firm GAWMiners. Garza has acquired BTC.com domain for a whopping $1 million and told Cryptocoinsnews that he had some remarkable things in the works in the mining space and digital currencies. Domain Guardians, the brokers, consider BTC.com domain just not catchy, but also has the power to establish the holder as a market leader. Bitcoin domains have off late been providing a huge stream of cash flow as evidenced from the recent sale of bitcoinwallet.com at $250,000.

Another mining pool operator, Ghash.io has reportedly generated $250 million worth of Bitcoins since it started functioning on August 3 of last year. The report is revealed at a time when the mining operator is surrounded by investigations for its oversized cut of the Bitcoin network hashrate, which is as close as 50%. For which, the company has started a campaign to defend the case with full transparency and is witnessing users’ support, who are increasing steadily.

On the contrary, Kyrgzstan's central bank is not happy with bitcoin as it has released statements indicating that the use of cryptocurrency is illegal. The National Bank of the Kyrgyz Republic has not only alerted about the risky nature of the virtual currency, but has gone one step ahead to warn Bitcoin users that they will violate the legislation of the Kyrgyz Republic, which will attract legal liability.