By: Ben Myers

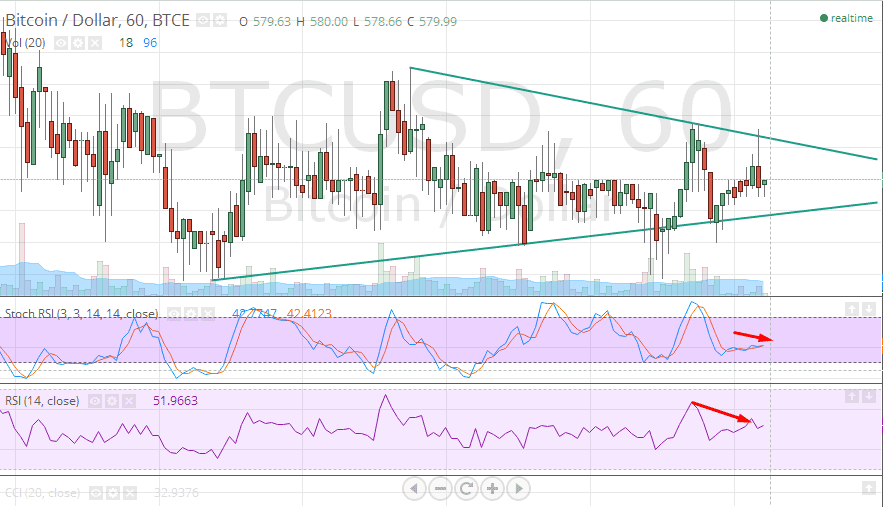

After the volatility of last week, things settled back to much of July’s pattern, with BTC/USD on the hourly charts continued trading in a very narrow trading range as traders and investors still try to grapple with the future direction for the digital currency. BTC/USD has formed a very good support at levels of $575 since last week. The resistance currently for the BTC/USD at the upward trading band comes at around $583. The stochastic oscillator for the BTC/USD has been trading in flat terrain and showing no signs of a reversal either on the upside or the downside at the current moment. The relative strength index showed some signs of strength but has formed a lower high which is a divergence from the current trend and therefore traders should maintain a strict stop loss. The stop loss for long trades should be maintained at $572 and for short trades at $585.

The New York Department of Financial Services outlined proposed regulations with respect to governance of virtual currency, primarily Bitcoin businesses running in New York that are required to follow laid out rules for the safekeeping of data and protect their customer's privacy. Thus, the proposed regulations have recommended mandatory cyber security programs along with business continuity and disaster recovery program. The structure of Cyber security programs is very much similar to the written information security programs that outline five core cyber security functions like identifying cyber risks to responding and recovering from the risks emerged. These regulations are currently open for a 45-day public comment.

Unlike the U.S., the United Kingdom is dealing with Bitcoin differently as its Chancellor George Osborne put in place a new initiative to look deeper into the strengths and risks of the virtual currency. The report is expected to arrive by Autumn, which will decide the future course of action for the digital currencies in the UK. It is to be noted that the UK is actively making efforts to become a global center for financial innovation and thus, this step should be counted among one.

On the other hand, a huge presale of "ether" tokens at Ethereum is on, which has invited mixed reactions from the Bitcoin community. Ethereum functions way similar to Bitcoin, but the sale has the ability to create an extreme effect. Either it could change the game completely or could fizzle out like yet another big scam. However, as of now, the presale has had no effect on Bitcoin prices.