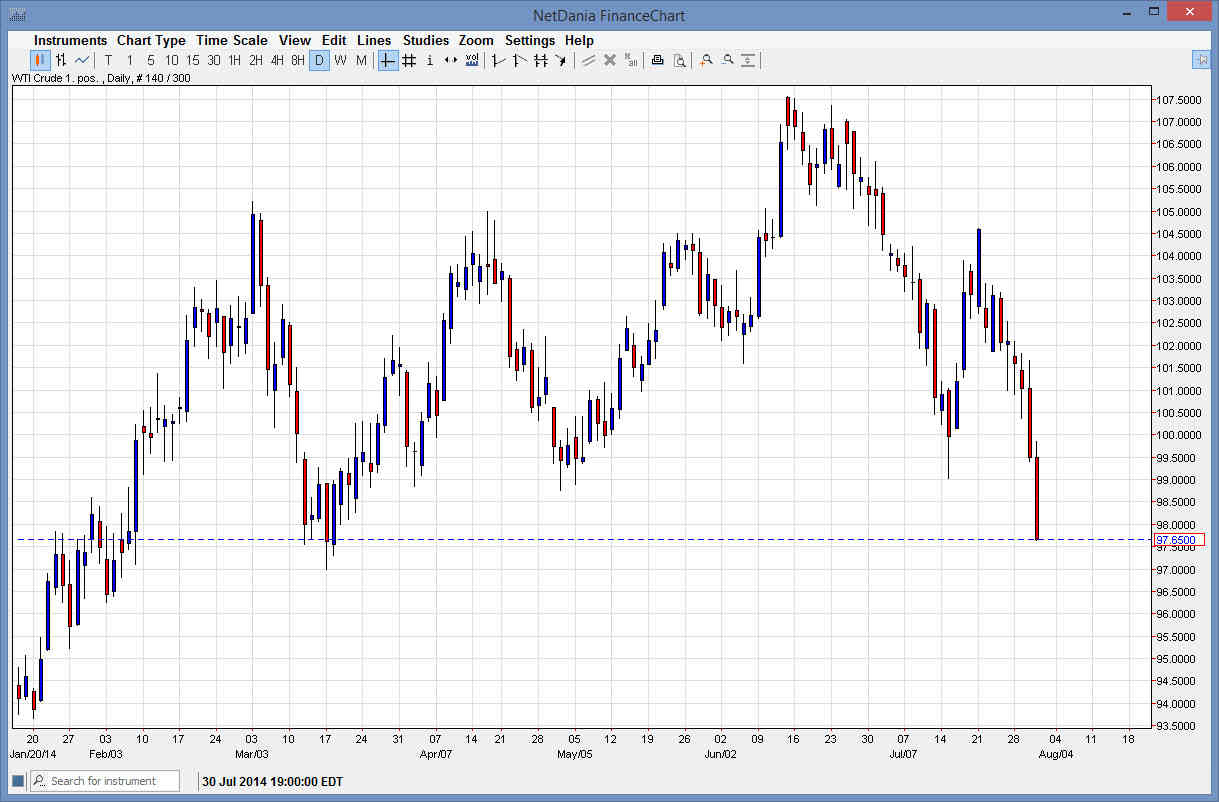

The WTI Crude Oil markets fell again during the session on Thursday, as we continue to plow lower. You can see that we have a significant amount of bearishness in the market all of a sudden, and the fact that we are testing the $97 level of course does concern me as I see it a major support level. With that, I believe that the announcement today, the US Nonfarm Payroll number, will be greatly influenced when this marketplace. After all, the correlation is typically the more jobs, the more petroleum demand.

However, with this kind of bearishness I would be more apt to sell this market on a bounce that show signs of resistance somewhere near the $99.50 region. I think that any initial reaction in this market will probably be short-lived, because there are obviously a lot of issues with the WTI contract at the moment.

Looking at this market, I see nothing but trouble.

But in this market, I see nothing but trouble at the moment, as there is a bit of a freight train effect going on. Simply put, I don’t want to catch any falling knives, so I’m going to wait for a supportive candle on at least the daily timeframe to even think about going long at this point. Yes, I see that we are getting close to significant support, but the fact that we close at the very bottom of the candle for the day on Thursday suggests to me that bearishness should continue overall.

That being said, we are heading into August, a traditionally slow time of the markets anyway. With that being the case, the bounce could be very short-lived if we get it. It is not until we get above the $100 level that I would even consider going long, and at that point in time I think it would still be a fairly bumpy ride higher. Going forward, I think that this market will continue to be bearish for at least the next month, and that rally should simply provide selling opportunities.