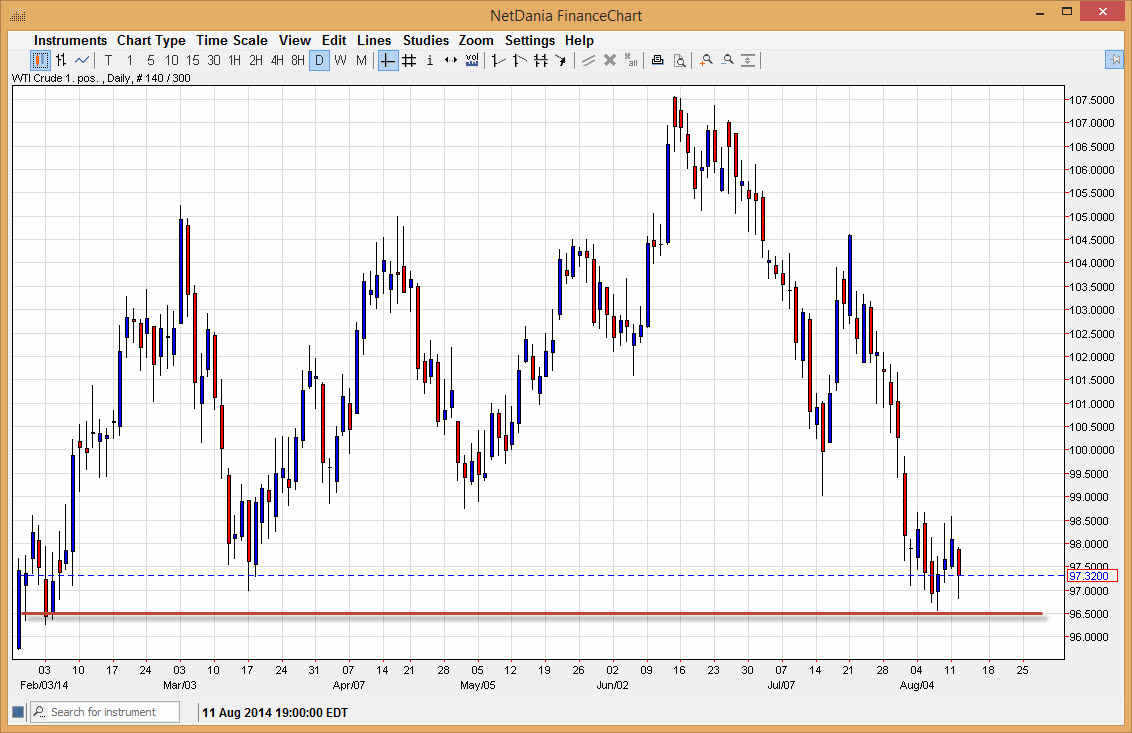

The WTI Crude Oil markets initially fell during the course of the day on Tuesday, but we have found support near the day $6.50 level again. This is an area that has been supportive lately, so I believe that the market should continue to meander around this general vicinity. It should be noted that the Brent market did in fact break down during the session, so certainly the pressure is on the market right now. After all, both of these markets tend to move in the same direction but the $96.50 level has been so supportive lately that I am a bit hesitant to start selling at this point.

On top of that, the candle was in fact a hammer, and that is pretty significant. A break above the top of the hammer doesn’t mean as much at this point though, simply because we need to get above the recent consolidation area which I see as topping out at the $90.50 handle. If we get above there, I think the market then heads to the $100.00 level, which of course is a large, round, psychologically significant number.

Do we continue consolidation?

I believe that the real question is whether or not we can continue consolidation. The larger market move has been from the $96.50 level to the $104.50 level, possibly the $105.00 level. In other words, we are in a massive consolidation area. The summertime trading conditions are normally fairly quiet overall, so the fact that we have sold off this significantly is a bit surprising to me.

I do think that the bounce that’s coming in my opinion could be difficult for the market to sustain for long periods of time though, and as a result the market will more than likely be very choppy between here and the top of the consolidation area. Ultimately though, it would not surprise me at all if we got to the top of the consolidation area, but right now the market has been so volatile that I am comfortable simply waiting for it to prove itself in one direction or another.