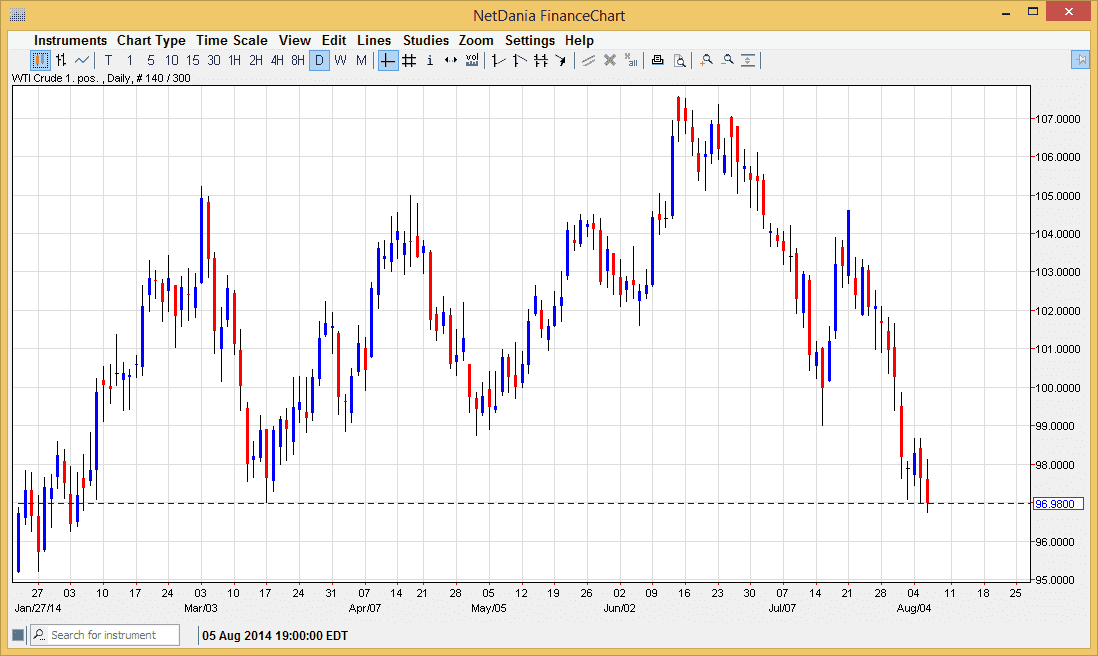

The WTI Crude Oil markets initially tried to rally during the session on Wednesday, testing the $98.00 level and finding a significant amount of resistance. However, the market turned back around and then fell slightly below the $97.00 level, an area that I anticipate should be rather supportive. Unfortunately, we did not getting close far enough below the $97.00 level for me to be confident in selling this market, so I think at this point we just simply have a weak market that simply doesn’t know what to do at the moment.

I believe that ultimately the $95 level below will be massively supportive as well, so I would expect a bounce sooner or later, simply because we are certainly in the oversold condition at the moment. If we can get a bounce, I believe the $99 level will be targeted first, then the $100 level, and then possibly the $105 level if we can get that strong. However, right now there isn’t that much in this marketplace and looks that strong, so that could be a bit of a tall order.

US dollar could be an influence as well.

The value the US dollar could be influencing this market as well, as it continues to strengthen against almost everything else. However, the US Dollar Index formed a massive shooting star for the day, which of course means that perhaps will get a little bit of a pullback in the value the US dollar overall. Nonetheless though, I do believe that the US dollar will continue to strengthen over the longer-term, and that could be very bad news for the oil markets as they are of course priced in that particular currency, and the inverse correlation typically holds over long periods of time.

If we break down below the $95 level, I think we could see a little bit of a panic in this market, as we would head straight to the $90 handle. Ultimately though, oil traders do like to go along as often as possible, so I really do think that we will have some type of stabilizing effect relatively soon. At this moment though, I don’t see any reason to be involved.