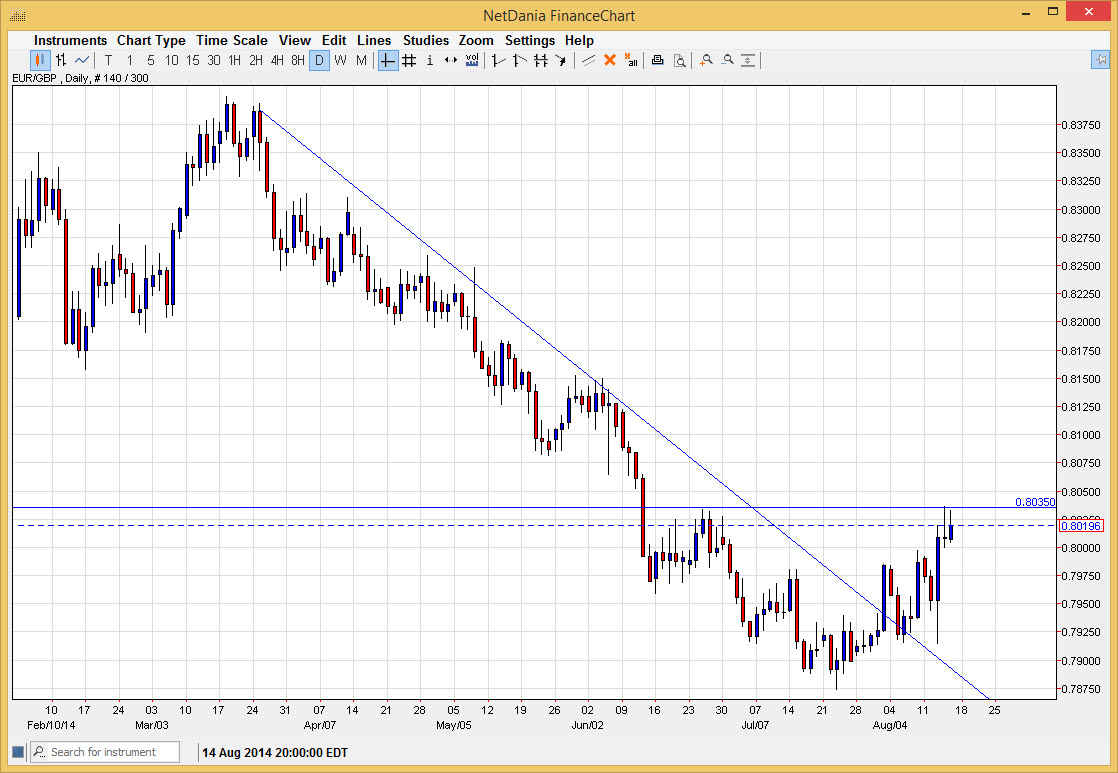

The EUR/GBP pair rallied during the session on Friday, testing the 0.8030 level. This area offered resistance back during the month of June as well, and now that we have tested it again, it’s hard for us not to notice that the market moving above that level. That of course would be very strong, and should head towards the 0.81 level initially. On top of that, I believe that the market will have changed trend at that point, and should continue to go higher. I think that the fact that we broke above the trend line on the chart and retested it certainly suggests that be heading in that general direction.

Nonetheless, if we pullback from here we will more than likely test the consolidation area down at the 0.7925 level. With that, I would be surprised if we saw some type of support in that general vicinity as well. However, if we break above the aforementioned 0.8035 level, it will have not only broken above a resistance barrier, but the top of the shooting star that was so prominent during the Thursday session. That would be at least two reasons that we should go higher, and therefore I feel quite a bit more comfortable buying above there.

At this point in time though, the downtrend only has a brief moment to prove itself.

I believe that the market needs to prove itself on the downside here soon, or we will break much higher. The Euro looks like it has a bit of support underneath it against several currencies right now, and this being the case the market could very easily lead to a move higher in this market. This is especially true considering that the British pound has been taking a real beating against the US dollar as well.

The real question is whether or not we can hang onto the upward momentum of course. The next day or two should be very vital in this marketplace, and in the 0.8035 level for or my money is one of the most important levels on this chart now.