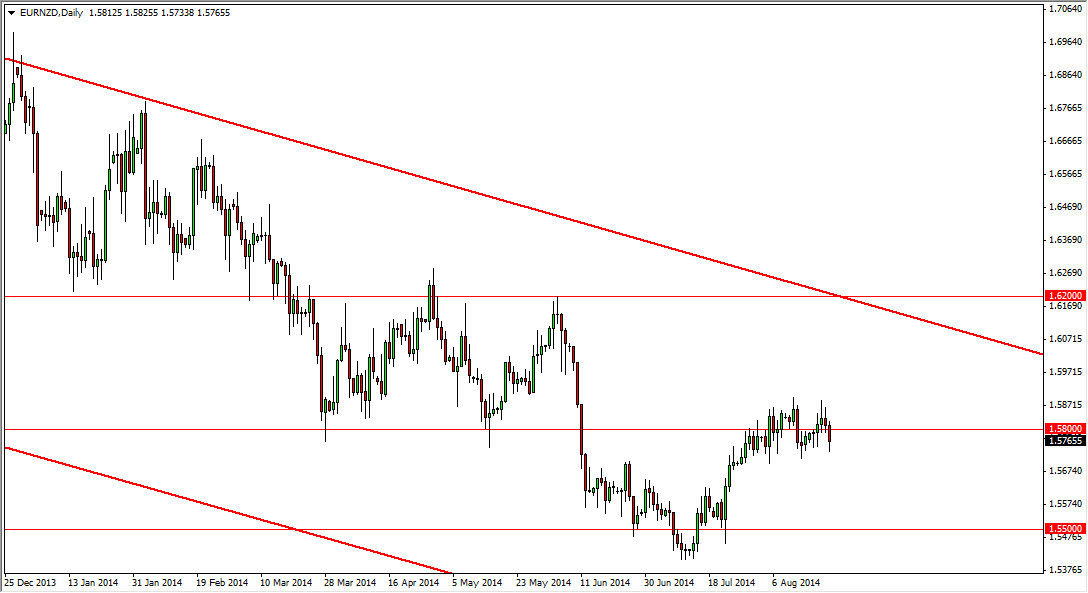

The EUR/NZD pair fell during the session on Friday, as we continue to hang around the 1.58 level. The Euro itself is in trouble overall, but then again so is the New Zealand dollar. It’s difficult to decide which currency is probably worse off, but at the end of the day the easiest thing to do is simply follow the trend. The trend in this pair is down, and as a result I don’t see any reason whatsoever to fight that trend at this point in time.

I believe that a break below the 1.57 level should send this market looking for the 1.55 level, and possibly lower. The Euro continues to struggle considering the fact that the European Central Bank will have to keep its monetary policy quite loose, and New Zealand still continues to have stronger interest rates than the European Union. Ultimately, it is interest rates that drive currencies overall, so it makes sense that we will continue to grind a little bit lower. Ultimately, I believe that we go down to the 1.50 level, and recognize that although this pair could be very choppy, the reality is that the world is focusing on the Euro, and not so much the commodity currencies as far selling is concerned.

Downward channel.

The downward channel on the longer-term chart seems to continue to keep this market going lower, and as a result I feel that selling on the bounces should continue to be the way going forward, and I would invite you to pay attention to this nice trend as the spread in this pair is typically somewhere near three pips or so. A lot of you want pay attention to this marketplace, but it does feature two major currencies so therefore you should not fear trading it at all. Quite frankly, you have to keep in mind that being such a nice trend makes this a very easy trade to take. There aren’t a whole lot of trading markets at the moment, so when you see one, you should take advantage of it.