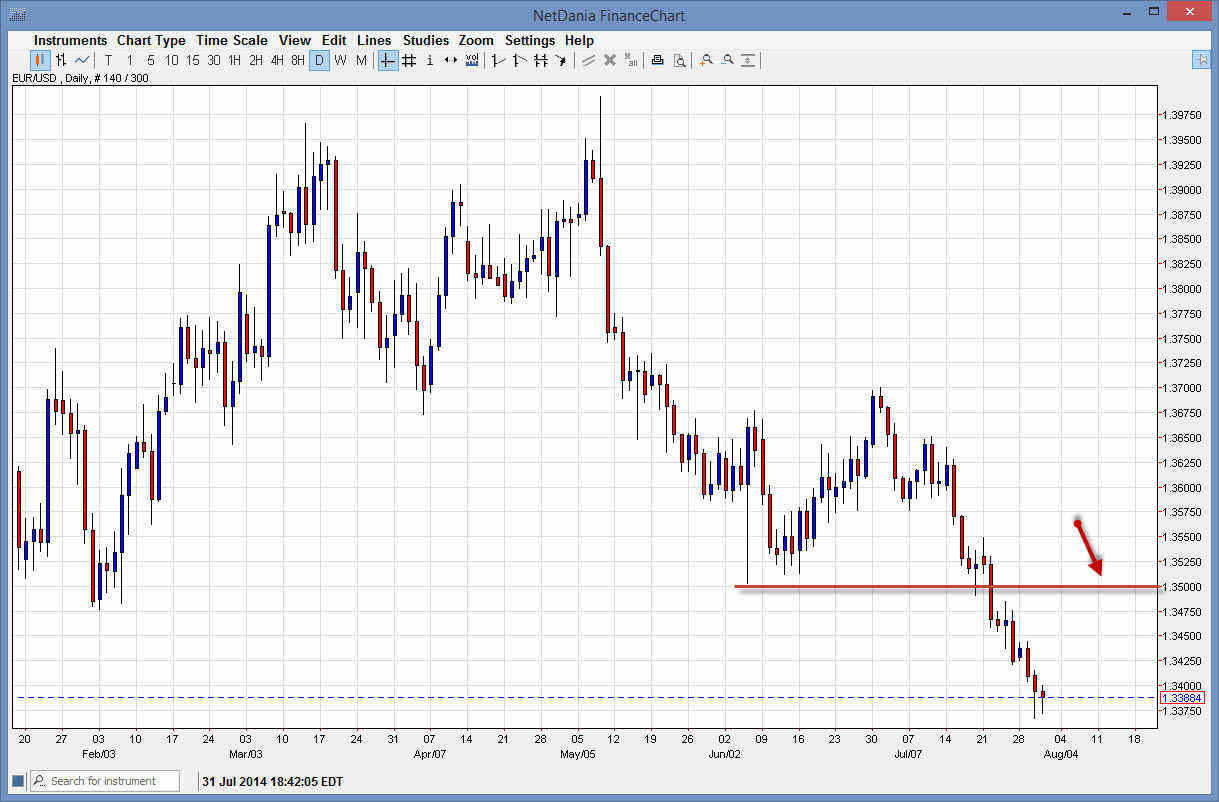

The EUR/USD pair fell during the course of the day on Thursday, but as you can see found enough support at the 1.3375 level to turn things back around, and form a hammer. This is a second day in a row that we have seen this formation, and as a result I think that this market is rather well supported in this region, at least temporarily. After all, today is nonfarm payroll Friday, and as a result this market will certainly see some volatility.

I believe that the market simply couldn’t continue following the sharp trajectory lower right before the employment numbers. After all, it is one of the biggest announcements in the world, and as a result most traders would probably be a bit hesitant to add to their positions. However, the fact that we have formed to hammers in a row suggests to me that perhaps we could get a little bit of a bounce here, which is probably overdue.

Selling opportunity?

I believe that this could be a potential selling opportunity if we get the bounce that it looks like we could. After all, you can see that I have the 1.35 level marked on the chart and I think that there will be a significant amount of selling pressure in that region, if not just a little bit below there. With that, a resistant candle in that region should have us selling this market off again as it would be a nice chance to buy the US dollar “on the cheap.”

I still think of the real significant support is down at the 1.33 handle, and I think that we are heading down to that area. That being the case, I’m still bearish. However, we get a move above the 1.35 level on the daily close, at that point in time I would have to rethink and perhaps start looking at a return to the previous consolidation area from the 1.35 level to the 1.37 handle. Nonetheless, I think that continued bearishness is probably what we will see.