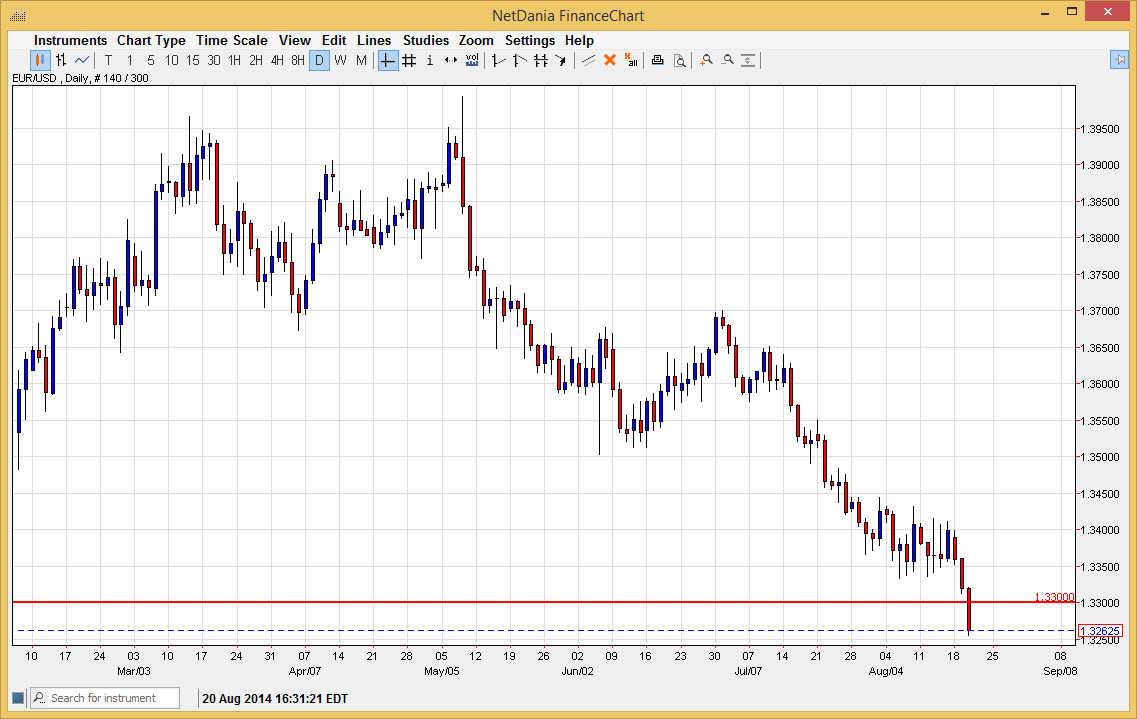

The EUR/USD pair broke down during the day on Wednesday, as the FMOC minutes were released from the last meeting, suggesting that there were perhaps more bullish members than originally thought. This of course means that interest rates could be going higher in the United States sooner than anticipated, and that of course is good for the US dollar overall.

With that, I believe that this market will continue to break down, and the market moving below the 1.33 level is in fact very bearish. The breaking down below there sends the market looking for another support level, and in my estimation that is and until we see the 1.30 handle. Granted, it will be very choppy on the way down there, but I do believe that’s where we end up given enough time as it is a large, round, psychologically significant number, and therefore a magnet for price.

The trend is set, and the ECB looks to accommodate.

It appears that the European Central Bank is looking to keep a very easy monetary policy, while the Federal Reserve is probably going to start tightening much quicker than anticipated. Because of this, it makes sense this market drops, and the value the euro is a little bit too high ECB’s liking. With that, I feel that the market is doing exactly what the central bankers wanted to do, and therefore should continue unabated.

Ultimately, there are small support areas between here and 1.30, and each one who should cause a bit of a bounce. It doesn’t matter what’s going on the world, somebody always wants to buy the Euro anyways. So with that, I believe that it’s very possible each one of these bounces should offer a short-term selling opportunity and I think that in order to trade this market, you will probably have to focus on shorter timeframe such as the hourly charts, as they can give you short-term trading opportunities in an otherwise choppy market environment. Nonetheless, I am only selling and have no interest in buying.