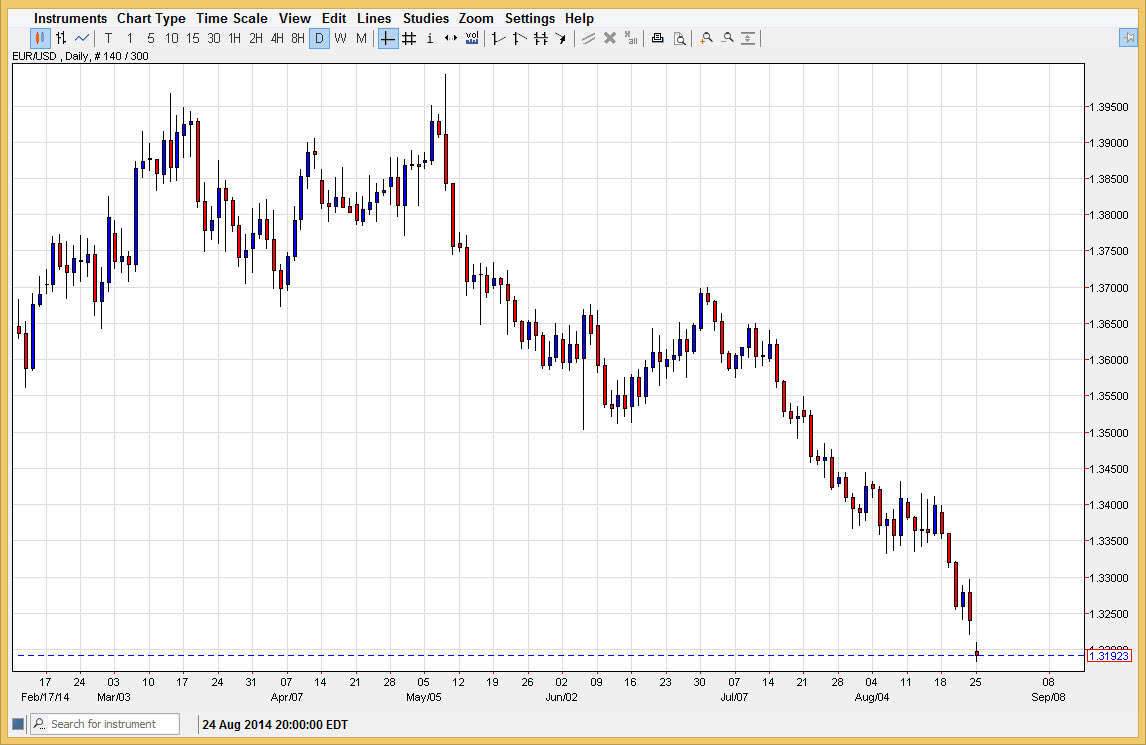

The EUR/USD pair gapped lower at the open on Monday, and then essentially did nothing. That being the case, it appears that the Euro is going to continue falling in general, and as a result I feel that the market can only be sold at this point. Once we broke down below the 1.33 level, I feel that something significant happened in the marketplace, and as a result the Euro has to fall to the 1.30 level in order to find significant support. However, I don’t necessarily believe that the level is going to be supportive enough to keep the market afloat, and that any supportive action there should be temporary.

I believe that the real support is down at the 1.28 level, which is much more significant on the longer-term charts. Because of this, I am essentially selling every time this market rallies on the short-term charts, recognizing that I could get a little bit of a bounce off of the 1.30 handle.

Continued bearish pressure.

With the entire world recognizing that the European Central Bank needs to loosen monetary policy, and the head of the ECB, Mario Draghi essentially saying the same thing at Jackson Hole, it’s hard to imagine a scenario in which the Euro continues going higher from here. That’s not to say that we can bounce from time to time, we certainly can. If nothing else, the Euro has shown over the years that there’s always somebody willing to buy it.

That being said though, I will look to shorter-term charts such as the hourly chart to find resistive candles at the gap, the 1.33 level, and other large, round, numbers. I believe that ultimately this is one of those setups that requires us to sell and sell again, probably not been able to be held onto. That being the case, if we break down below the 1.28 level, this market would fall completely apart. At this point in time, I don’t expect that’s going to happen, but that is a very real possibility. On the other hand, if we break above the 1.3450 level, I believe that the trend will have changed at that point and the market would continue to go higher.