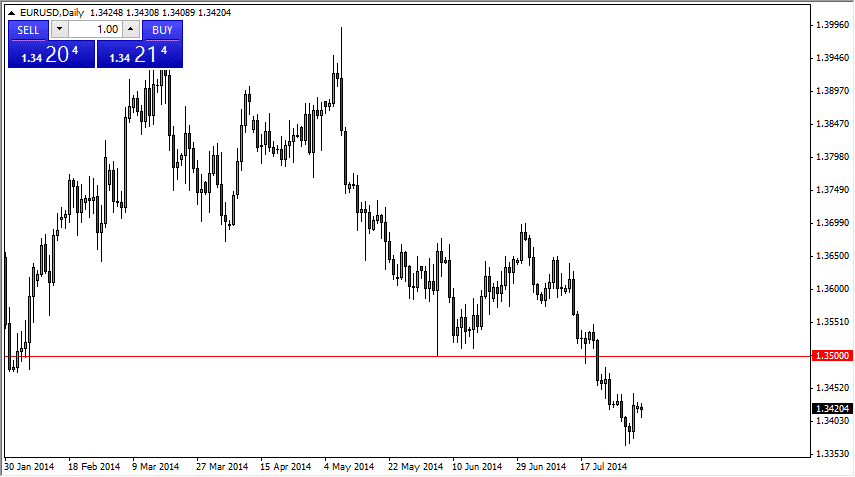

The EUR/USD pair initially fell during the course of the day on Monday, but as you can see the area below the 1.34 level offered enough support to turn things back around and form a hammer. The hammer of course is positive, but I still see a significant amount of resistance near the 1.35 level, so I think the market is going to struggle to get above there. I am actually going to ignore this hammer, and simply wait to see the market come to my level so that I can start selling.

The 1.35 level in my opinion is an excellent selling opportunity, but I will have to see the right candle, such as a shooting star or engulfing negative candle. In the meantime, the range for the Monday session tells me that we are probably going to continue to be tight in the short term, but that’s okay as the summer time dictates that type of trading anyway, and I tend to avoid it at all costs as it simply isn’t worth the hassle.

Patience will be needed for this trade

Waiting on this trade is going to be crucial. The famous trader Jesse Livermore once was quoted as saying “we get paid to wait.” I think that’s a perfect way to think about this trade as simply waiting for “value” in the US dollar at the 1.35 level is how we should go. That’s not to say that the market can go above there, and quite frankly I believe that a move above the 1.3550 level negates any selling for the short term. In a daily close above that level probably since this market to the 1.37 handle in the immediate move. However, I think that the downward trend is so strong that I find it very difficult to imagine that there won’t be at least some selling in the region of the 1.35 handle. Once we get that selling, I believe that we could go a bit lower than last time, perhaps the 1.33 handle as it is such a massive support level.