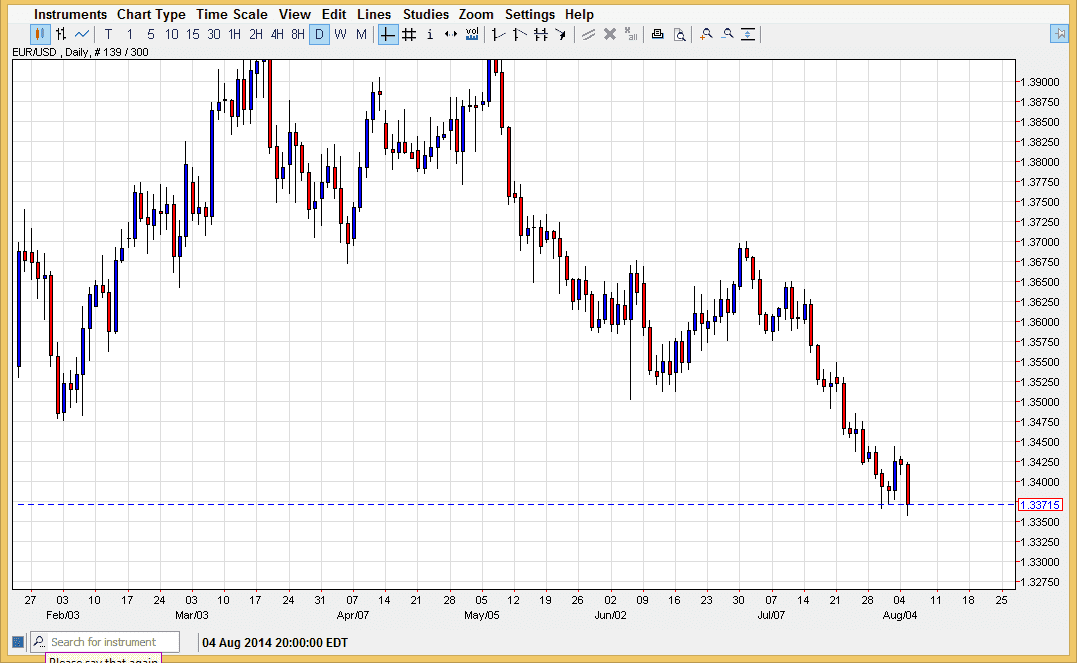

The EUR/USD pair fell during the bulk of the session on Tuesday, and even made a fresh, new low. Because of this, the market could continue lower, and aim for the next support level that I see being significant, the 1.33 handle. This is based upon longer-term charts, and I believe that the market is in fact aiming for that area overall. Yes, I can see that the market is oversold at this point, but ultimately we should continue to see the US dollar gained against the Euro, and if we managed to break below the 1.33 handle that would in fact be a massively bearish signal.

Because of this, I am still bearish in this market but would prefer to sell rallies when they appear. Obviously, the bounce that we got during the Friday trading session due to the nonfarm payroll numbers being slightly less than anticipated was a nice selling opportunity. I believe that that’s how this market will trade going forward, simply offering selling opportunities.

Don’t fight the trend.

This trend is so strong that although it is oversold, I would certainly not try to fight it. A rally at this point in time should bring sellers, and I believe that the perfect place to sell this pair from is actually the 1.35 handle. However, you could make a fairly significant argument against this market trying that level anytime soon. Because of this, you may just have to “take what you are given”, and sell down here.

I suspect that the European Central Bank will have to loosen its monetary policy sometime over the next several months, and this could be the market preparing for that. The stock indices in Europe don’t look much better, and as a result I feel that money is just leaving the European Union in general. With that, I am bullish the US dollar and I believe that the US dollar in general is getting a bit of a Renaissance at the moment as trader step back into it after shunning it for so long.