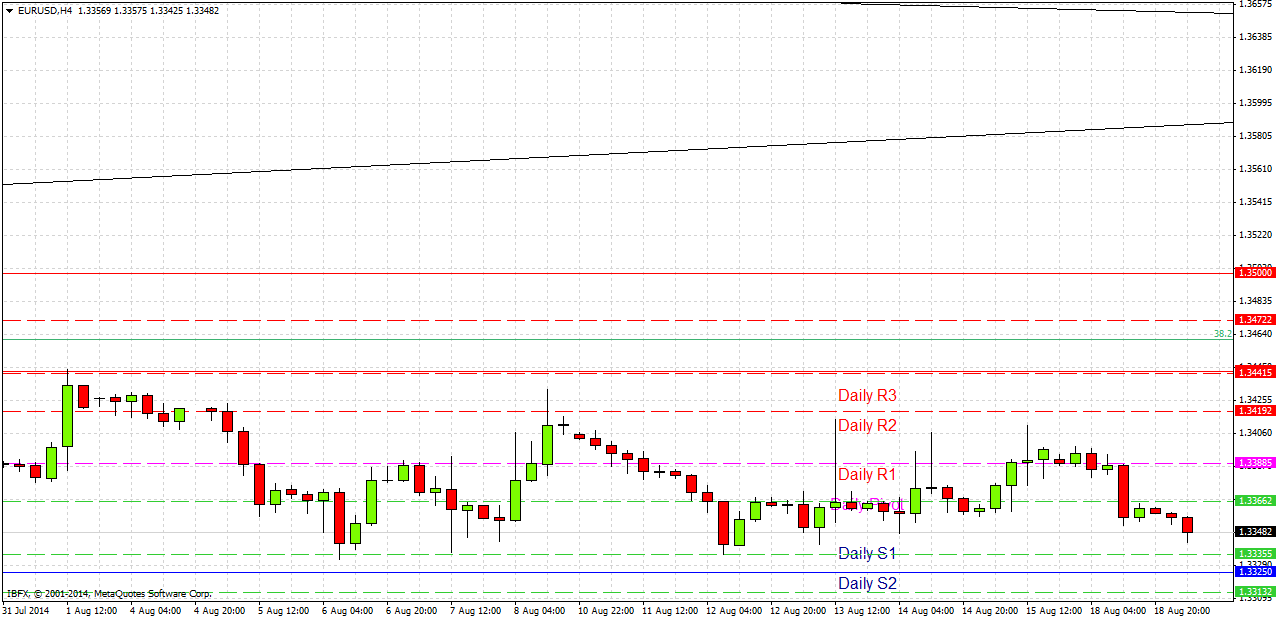

EUR/USD Signal Update

Yesterday’s signals were not triggered as the price never reached either 1.3325 or 1.3442.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries may only be made between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 1.3325.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3440.

Remove 50% of the position as profit at 1.3440 and leave the remainder of the position to ride to 1.3500.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 1.3442.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.3325.

Remove 75% of the position as profit at 1.3325 and leave the remainder of the position to ride.

EUR/USD Analysis

The consolidation between the key levels at 1.3325 and 1.3440 has continued, and it has now been going on all August. Yesterday I expected a rise was more likely than a fall but in fact the price has dipped and is now approaching 1.3325. If this level is hit before the news release due later today shortly after the beginning of the New York session, it should hold. It is hard to say what will happen next.

The levels should both be good for trades if they are confirmed by subsequent price action. We have much bigger USD news due tomorrow (FOMC minutes release) and the consolidation area is quite likely to hold until then.

There are no high-impact data releases due today concerning the EUR. Regarding the USD, there will be data releases at 1:30pm London time concerning CPI and Building Permits. Therefore it is likely to be a quiet today until the New York session begins.