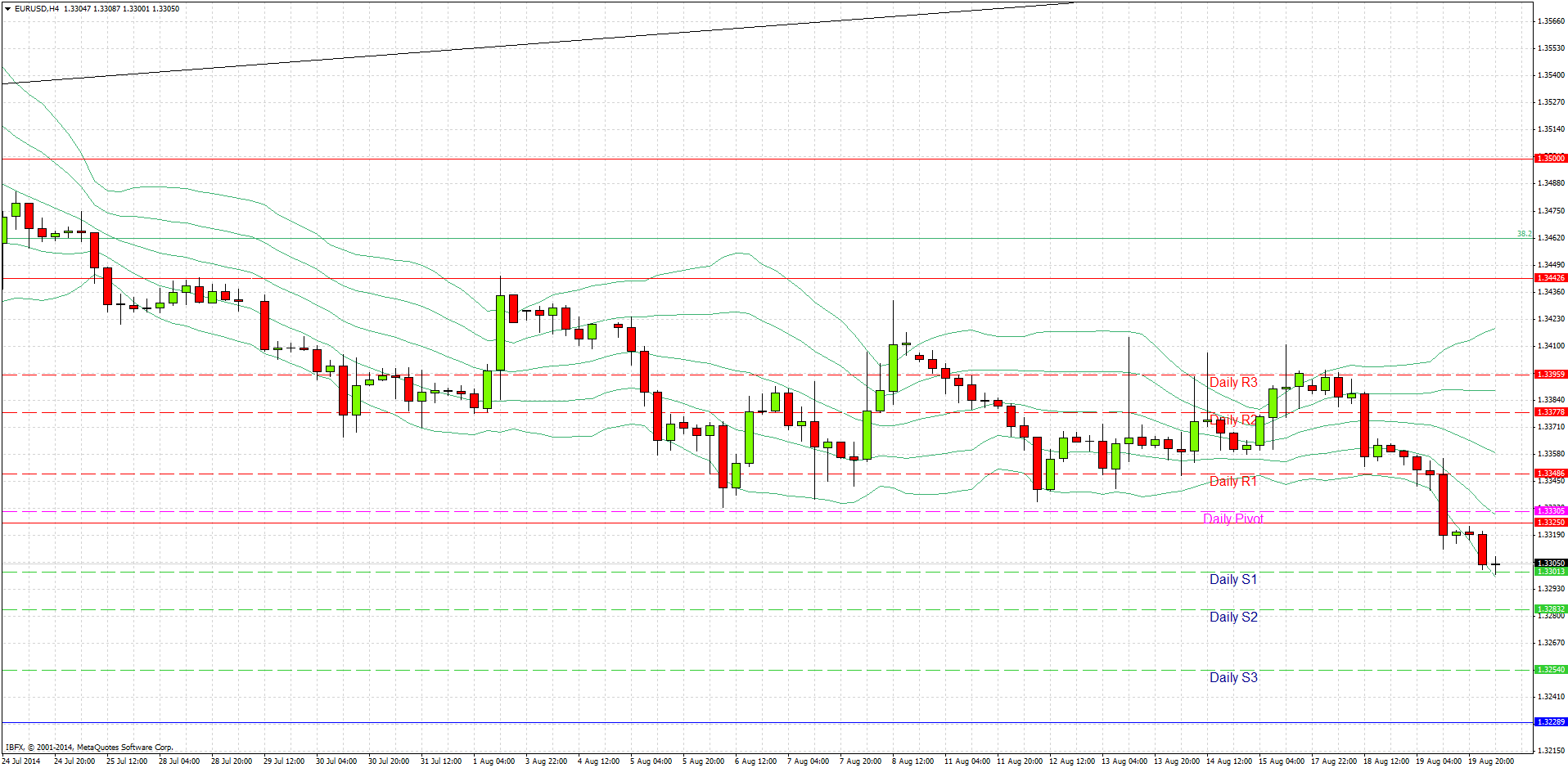

EUR/USD Signal Update

Yesterday’s signals were not triggered. The price did reach 1.3325 but there was no bullish price action there to trigger a long trade.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries must be made before 5pm London time today.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of 1.3229.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3300.

Take off 75% of the position as profit at 1.3300 and leave the remainder of the position to run.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 1.3325.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.3325.

Take off 50% of the position as profit at 1.3250 and leave the remainder of the position to run.

EUR/USD Analysis

I wrote yesterday that 1.3325 was quite likely to hold. Although the news releases yesterday were not especially positive for the USD, the USD continued to strengthen afterwards, and the level was broken. It is now likely to flip from support to resistance. In fact there was already a mini-pullback to a price very close to this level, followed by a continuation of the downwards move.

The main story of the market right now is USD strength. There is important USD news due later tonight towards the end of the New York session. If the news is bullish, we can expect even more strengthening.

The next major support level below the current price is at 1.3229.

The most likely trade during today’s London session would be a short following a pullback to the 1.3325 level.

There are no high-impact data releases due today concerning the EUR or USD, except for the FOMC Meeting Minutes which will be released at 7pm London time. Therefore it is likely to be a quiet today until that time.