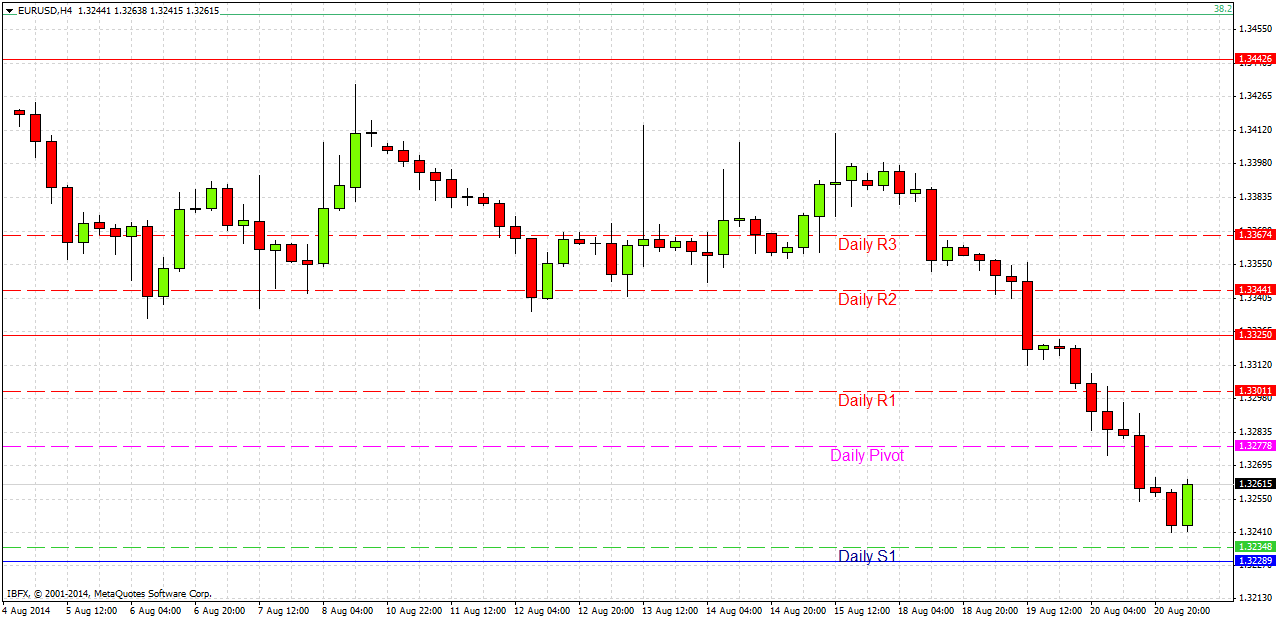

EUR/USD Signal Update

Yesterday’s signals were not triggered as the price did not reach either 1.3229 or 1.3325.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries may only be made between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 1.3229.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3260.

Remove 75% of the position as profit at 1.3260 and take off the rest at 1.3295.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 1.3325.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.3325.

Remove 50% of the position as profit at 1.3260 and leave the remainder of the position to ride.

EUR/USD Analysis

I wrote yesterday that if the FOMC minutes were bullish, we could expect even more USD strengthening. This is exactly what happened and the USD is now strong across the board, and has pushed this pair down even further. We are approaching the 1 year low and are currently at a 10 month low.

Bias is definitely bearish but there may be room for a conservative long off the support level at 1.3229 if this is confirmed by price action. Short trades have more room to develop and are higher probability winners. The obvious level at which to go short would be at a pullback to 1.3325.

There are high-impact data releases due today concerning both the EUR and the USD. At 8am London time there will be French Flash Manufacturing data followed half an hour later by the German equivalent. At 1:30pm there will be U.S. Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm, both of which are likely to affect the USD. Therefore today this pair is likely to be active.