EUR/USD Signal Update

There are no outstanding signals.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries may be made only between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame following a first touch of 1.3322.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.3440.

Remove 75% of the position as profit at 1.3440 and leave the remainder of the position to run.

Short Trade

Short entry following bearish price action on the H1 time frame following a first touch of 1.3442.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.3325.

Remove 50% of the position as profit at 1.3325 and leave the remainder of the position to run.

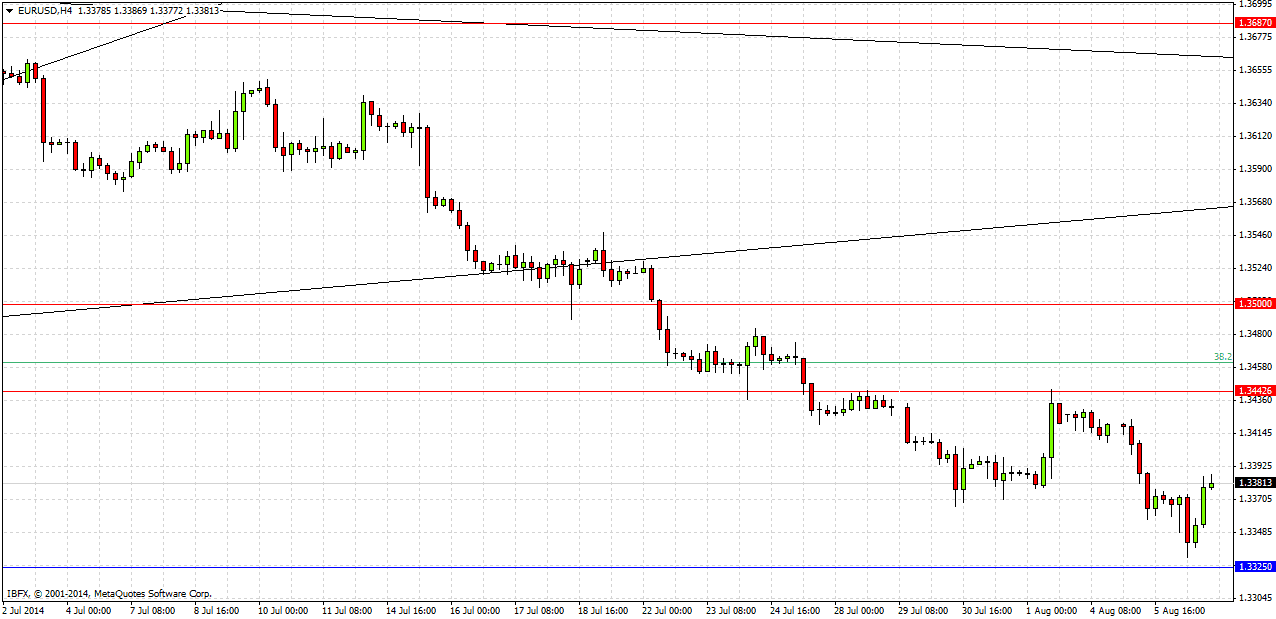

EUR/USD Analysis

Following a fairly brief rally during the second half of June during which this pair hit a high of 1.3700, there has been a moderate downwards trend. Early yesterday we made a low which has not been seen since November 2013 at 1.3332. This was close to a flipping support/resistance level at around 1.3325 which produced both weekly highs and lows last year, and the price has risen from there with some momentum, producing a nice bullish semi-pin candle on the daily chart yesterday. This suggests that we are ready now for a rally although it might be brief. The question is whether this will be supported by the data that is due out today around the start of the New York session. If there is nothing to dampen the EUR and the USD data is weak, the price should rise during today’s New York session, but is likely to be quiet until about Noon London time.

There is a flipped resistance level at 1.3442 which would be the likely place for an upwards move to stall, at least initially.

There are high-impact data releases due today concerning both the EUR and the USD. At 12:45pm London time the ECB will announce the Euro’s Minimum Bid Rate. Later at 1:30pm there will be an ECB Press Conference and a release of US Unemployment Claims data.