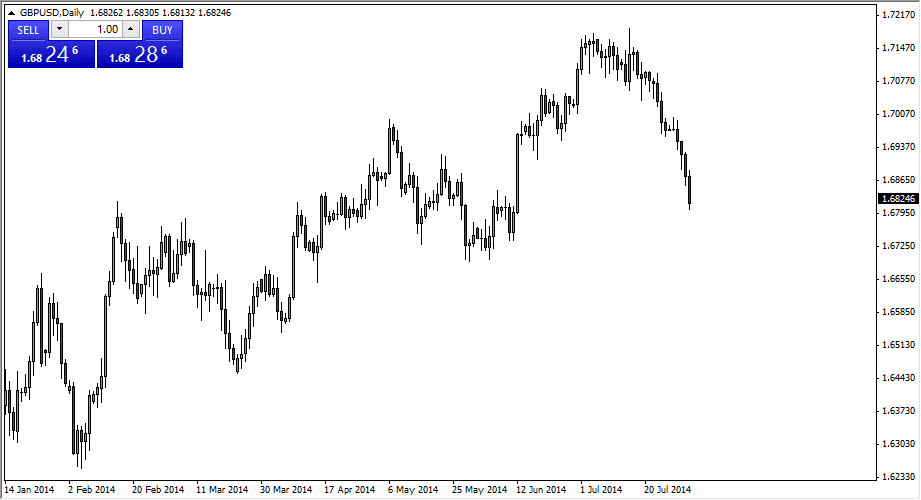

The GBP/USD pair fell again during the Friday session, as we had more of a “risk off” move in the markets in general. With that, it feels like the market is starting to get a bid to the oversold side at the moment, in the 1.6 level should be somewhat supportive as it has been important in the past. Because of this, I am looking for some supportive candle to play the bounce, and will be patient, waiting for a daily close in order to do so.

I still believe that ultimately we could see some strength come back into the British pound, but the real test will be if we can get above the 1.70 level to the US dollar. Move about there would in fact reassert the uptrend, and how this market more than likely heading towards the 1.72 level, and then the 1.75 handle which of course is larger as far as significance is concerned.

Being patient will be crucial

I believe that we will eventually get a clear sign to start buying again, but you are going to have to be patient in order to do so. Because of that, I will not make a move until I see a daily close that is indicative of a supportive moves such as a hammer, or perhaps a bullish engulfing candle, especially near a large, round handle.

Because of that, I think that short-term trading will be a quick way to do your account, and something that you should probably avoid at all costs. That is somewhat ironic considering that I believe most of the Forex market will be short term based for the next several weeks, but this might be the exception.

That being said, I still hold a bullish bias, and selling is probably going to be very difficult to do so now that we have already been so bearish for a couple of weeks. Ultimately, it could be a choppy couple sessions down in this area, but I do believe some earlier the buyers will have to reappear.