GBP/USD Signals Update

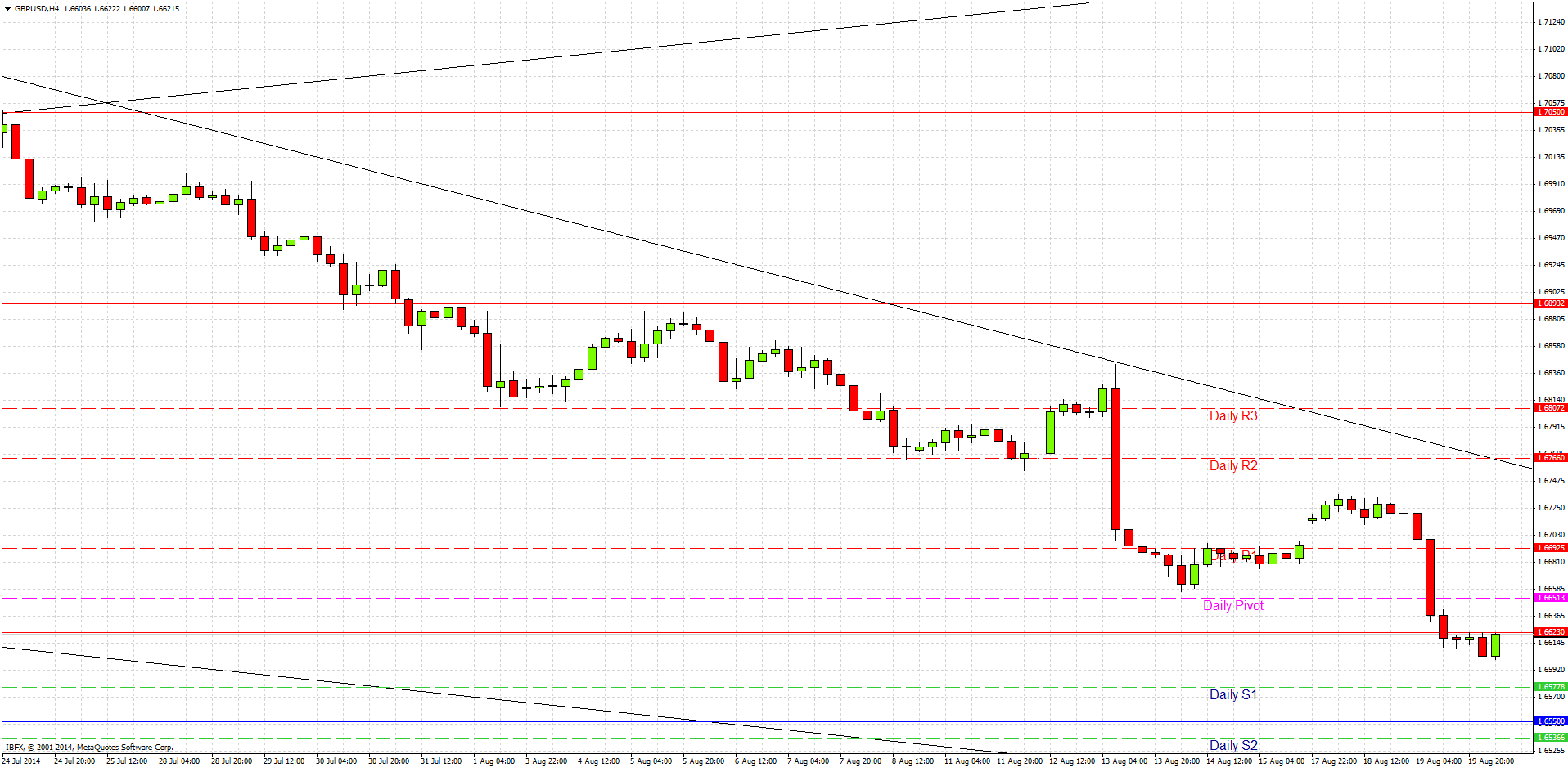

Yesterday’s signals were not triggered. The price did reach 1.6623 but there was no bullish price action there to trigger a long trade.

Today’s GBP/USD Signals

Risk 0.75%.

Entries must be made between 10am and 5pm London time today.

Long Trade

Go long at the first touch of 1.6550.

Place a stop loss at 1.6515.

Move the stop loss to break even when the price reaches 1.6585.

Take off 75% of the position as profit at 1.6585 and leave the remainder of the position to ride to 1.6620.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 1.6623.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6600.

Take off 75% of the position as profit at 1.6600 and leave the remainder of the position to ride.

GBP/USD Analysis

I was wrong in my expectation that 1.6623 would hold yesterday. It was broken and now might have flipped from support to resistance. The price is currently just underneath this level. If an hourly candle closes above it, it should be considered invalidated, but it might instead provide a good opportunity for a short trade. This must be confirmed cautiously by bearish price action.

Below us there is a nice flipped resistance to support level on the daily chart at 1.6550. If the news spikes the price down to that level, it could provide a nice long touch trade opportunity.

Concerning the GBP, there is important news due at 9:30am London time: MPC Asset Purchase Facility and Official Bank Rate Votes. There is nothing due for the USD during today’s London session. Therefore the morning is likely to be active, followed by a quiet remainder of the session if there was no unexpected news.