GBP/USD Signals Update

Yesterday’s signals were not triggered as the price did not reach 1.6550 or show bearish price action when it reached 1.6623.

Today’s GBP/USD Signal

Risk 0.75%.

Entries may only be made between 8am and 5pm London time today.

Long Trade

Long entry following bullish price action on the H1 time frame after the first touch of 1.6550.

Put a stop loss 1 pip below the local swing low.

Adjust the stop loss to break even when the price reaches 1.6600.

Remove 75% of the position as profit at 1.6600- and leave the remainder of the position to run.

Short Trade

Short entry following bearish price action on the H1 time frame after the first touch of 1.6655.

Put a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 1.6600.

Remove 50% of the position as profit at 1.6600, half of the remainder at 1.6550, and then leave the rest of the position to run.

GBP/USD Analysis

The USD is strong across the board and was strengthened even further by the bullish content of the FOMC minutes that were released yesterday late during the New York session.

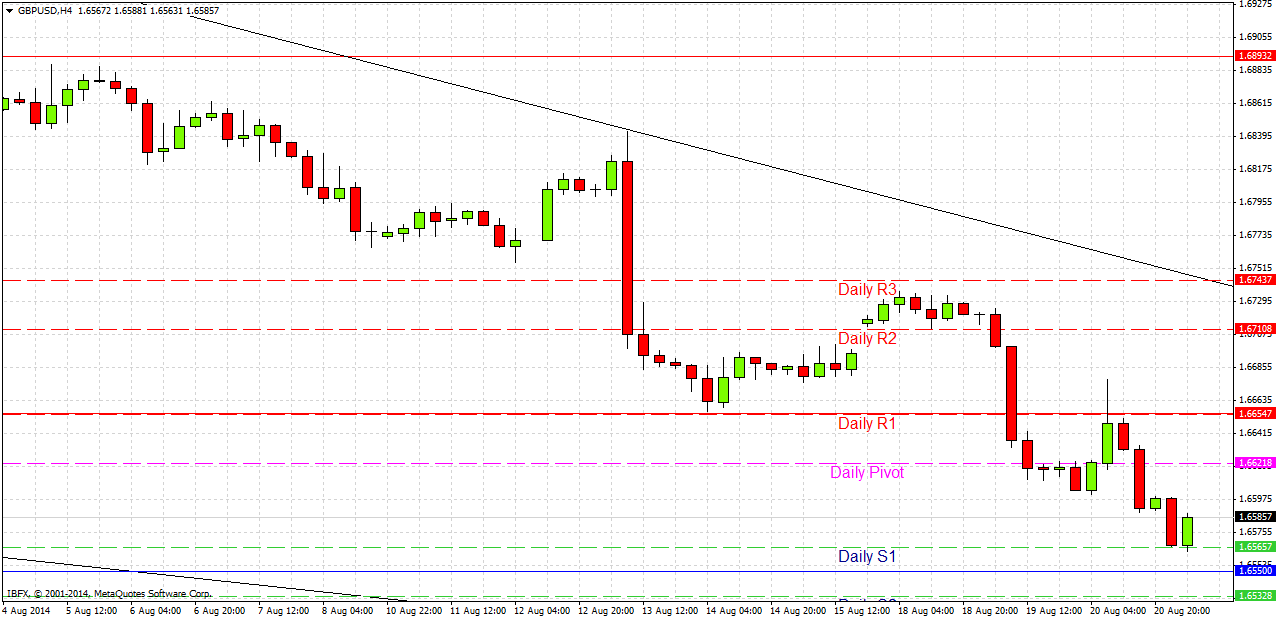

Technically, yesterday we printed new flipped support to resistance close to today’s GMT R1 pivot at 1.6655, so this will be a great and realistic level at which to look for a short trade today.

Below us there is a key support level at 1.6550 that is quite likely to be a good level at which to take a conservative long trade.

There are high-impact data releases due today concerning both the GBP and the USD. At 9:30am London time there will be U.K. Retail Sales data. At 1:30pm there will be U.S. Unemployment Claims data, followed by the Philly Fed Manufacturing Index at 3pm, both of which are likely to affect the USD. Therefore today this pair is likely to be quite active.