GBP/USD Signals Update

Yesterday’s signals did trigger a potential short trade after the price exceeded 1.6598, however the lower high was made very late in the London session, after which volatility died, signalling an exit for break even or a tiny profit.

Today’s GBP/USD Signals

Risk 0.75% of equity.

Entries must be made before 5pm London time today only.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of 1.6500.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.6571.

Take off 75% of the position as profit at 1.6571 and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame after the first touch of 1.6655.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.6600.

Take off 50% of the position as profit at 1.6600, half of the remainder at 1.6550, and then leave the rest of the position to run.

Short Trade 2

Go short following a strong lower high after the price exceeds 1.6605.

Place a stop loss 1 pip above the local swing high.

Take off 75% of the position when profit is twice risk and leave the remainder to run.

GBP/USD Analysis

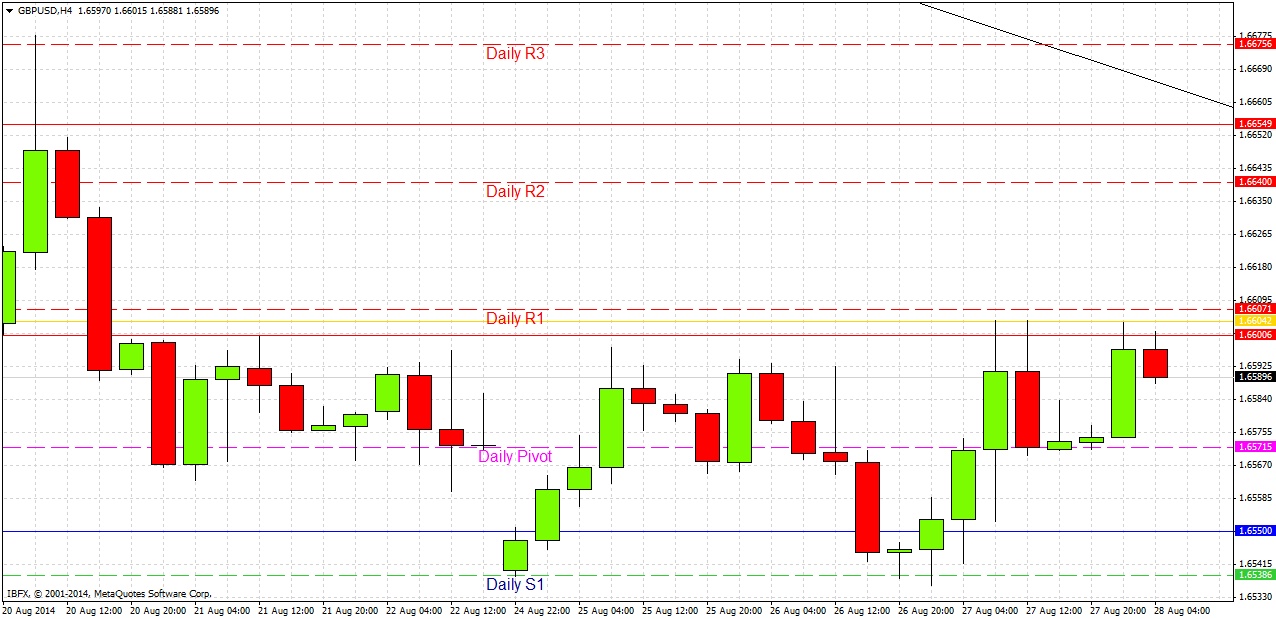

I anticipated correctly yesterday that we were likely to have a bullish pull back up to 1.6600, from which the price would then probably fall.

We have reached 1.6600 again overnight. If you look at a daily chart, you can see that for 4 days now this resistance has been tested over and over again. A bullish breakout of this level looks likely.

However if the level holds, or if we shoot up to 1.6655 and stall, short trades in line with the long-term bearish trend become possible. A bearish trend line is confluent with this level, making a short trade around there a more high-probability proposition.

There are no high-impact data releases schedules for a specific time today concerning the GBP. Regarding the USD, there will be Preliminary GDP and Unemployment Claims at 1:30pm London time, followed by Pending Home Sales at 3pm. Therefore the New York session is likely to be more active.