The XAU/USD pair initially rallied during the session on Friday -after the U.S. launched an air strike against militants in Iraq- but pulled back as sellers stepped in around the key resistance level of $1324. U.S. stocks also rose, giving less reason for investors to buy gold, on news that Russia was ending military drills near the Ukrainian border. For quite some time, the precious metal has reacted to the geopolitical headlines and maintained an inverse relationship with stocks. While geopolitical flash points give the bulls new opportunities to push prices higher, price gains are not sustainable.

I think some people are not getting aggressive because they feel the precious metal will lose its gleam once issues in different parts of the world are resolved. However, until the Federal Reserve comes to the point where it will be forced to considering raising the rates seriously, safe-haven demand will definitely have an influence on gold prices. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold (for the second consecutive week) to 121463 contracts, from 139153 a week earlier.

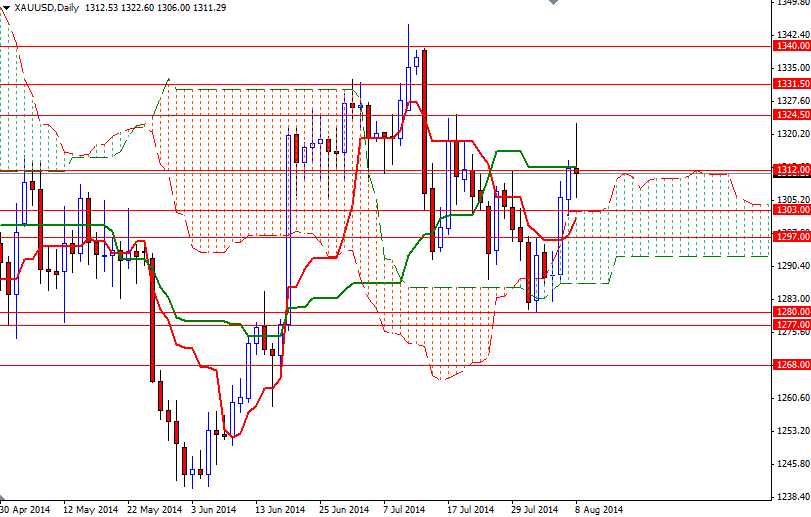

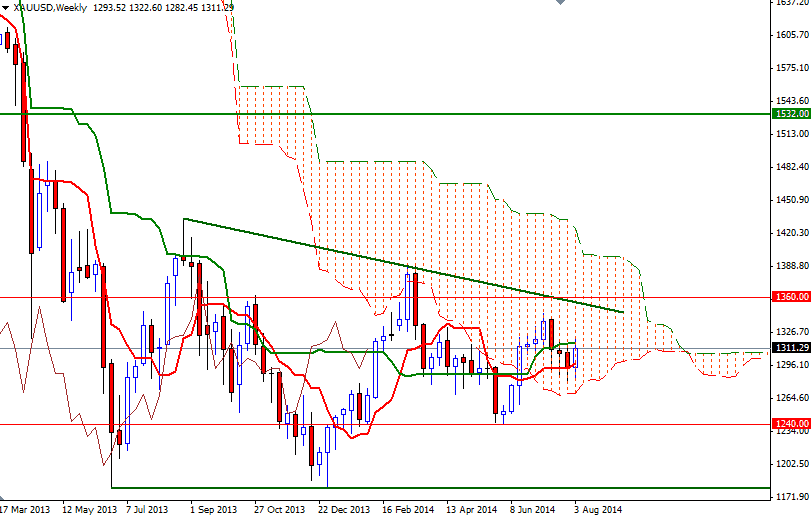

From a technical perspective, trading above the Ichimoku clouds (on the daily and 4-hour time frames) suggests that the path of least resistance for gold is to the north. But being trapped within the borders of the cloud on the weekly chart means the XAU/USD pair will be range bound for some more time. The area between the 1318 and 1324.50 levels has been resistive in the past so capturing this strategic point is essential if the bulls want to charge towards the 1331.50 level. If the market closes above 1331.50, it would be technically possible to see the XAU/USD pair testing the 1340 level. The top of the daily cloud currently sits at the 1303 level so that will be the first support to pay attention. Breaching that level might open the doors to 1297. Once below that, the bears' new targets will be 1288/6.