Gold prices settled lower yesterday, extending losses from Friday's session, as easing concerns surrounding Ukraine and Russia and signs of stabilization in the equities markets lured some investors away from the precious metal. Although news of humanitarian efforts soothed the market fears that the situation will escalate further, some investors highly doubt Moscow will change its course in Ukraine. Some days ago, NATO officials said "The quantity and sophistication of weaponry being sent by Russia across the border is increasing".

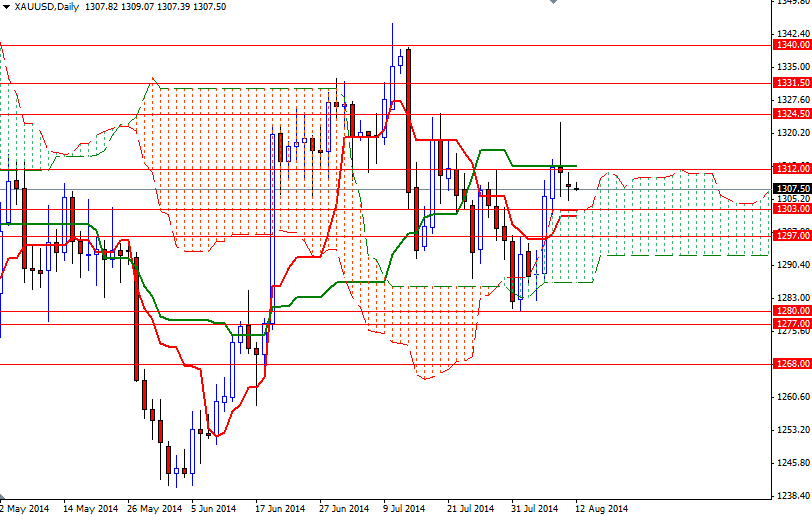

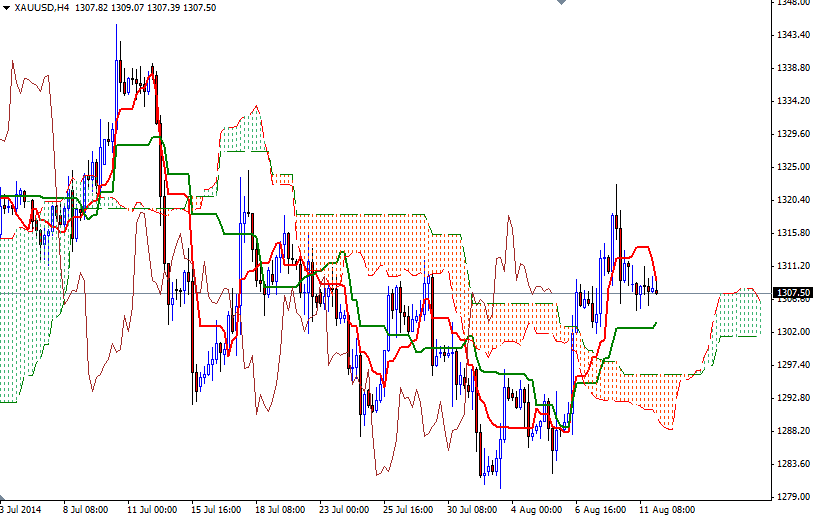

It appears that caution over the situation in Ukraine is limiting the down side but without any big escalation in geopolitical tensions the bulls will be struggling as well. Technically, trading above the Ichimoku clouds on the daily and 4-hour time frames provides support to the precious metal. However, in order to confirm that higher prices will come, I think a sustained break above the 1324.50/31 resistance area is essential.

Being trapped inside the cloud on the weekly time frame is another element which makes me not to expect a dazzling performance from gold. From an intra-day perspective, look for resistance around the 1312/5.50 area. If the bulls manage to break through, they will probably find another chance to test the 1318 and 1324.50 resistances. To the down side, I expect to see support around the 1303/2 zone where the top of the could on the daily chart currently resides. Closing below this level would make me think that the bears will be aiming for 1297 next