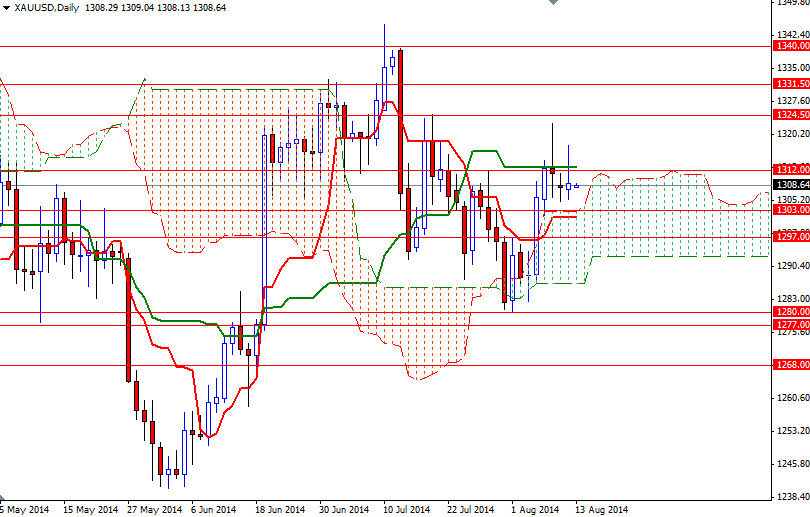

The XAU/USD pair closed Tuesday's session higher than opening after two consecutive days of losses. The pair tried to climb above the 1318 resistance level but the bears stepped in and increased pressure. As a result, the market remained within the previous four days trading range. On the one hand the precious metal is finding some support due to increasing demand for protection against geopolitical risks but on the other hand growing perception that the U.S. Federal Reserve will move closer to raising interest rates as the labor market improves is weighing on the market.

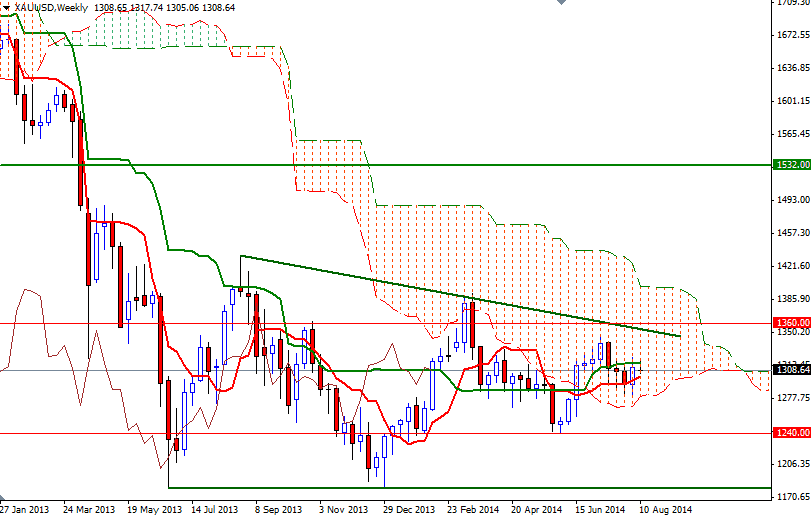

Recent price action suggests that neither the bulls nor the bears have enough power to overcome certain support/resistance zones and because of that I would prefer to wait until this battle is over. Although the XAU/USD pair maintains its bullish outlook while trading above the Ichimoku clouds on the daily and 4-hour time frames, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are flat and we are stuck in between.

To the upside, there will be hurdles in the way such as 1318 and 1324.50. If the bulls take the reins and push prices above 1324.50, it is likely that we will see the XAU/USD pair testing the next resistance level at 1331.50. Closing above this level on a daily basis would suggest that it is technically possible to see a bullish continuation targeting the 1340 level. The bears will have to push the market below 1303 - 1297 area in order to gain enough momentum to tackle the 1288/6 support.