Gold gained ground against the greenback for a second consecutive session on Wednesday as disappointing U.S. economic data and developments in the Middle East and Ukraine increased the metal’s safe-haven appeal. The XAU/USD pair traded as high as $1314.84 an ounce after a report released from the Commerce Department showed that retail sales were virtually unchanged in July. Although weak data reinforced the case for the Fed to keep the benchmark federal funds rate near zero for a long time, it might be a bit early to say that the U.S. economy will have trouble in the third quarter.

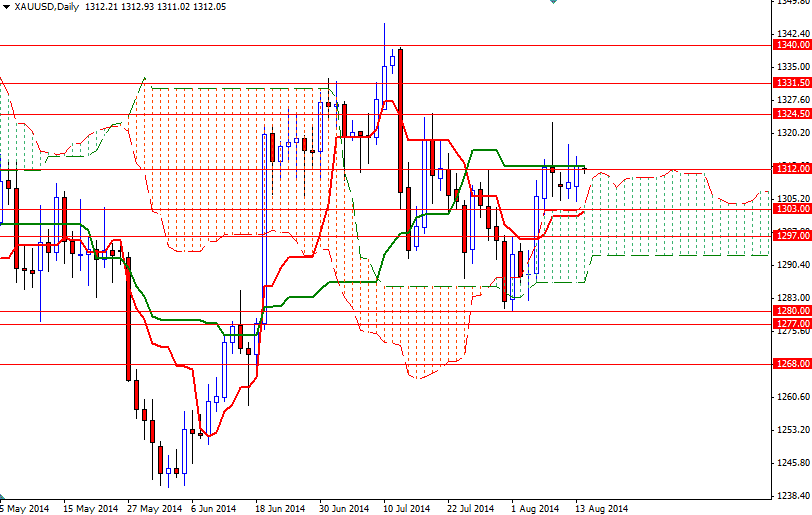

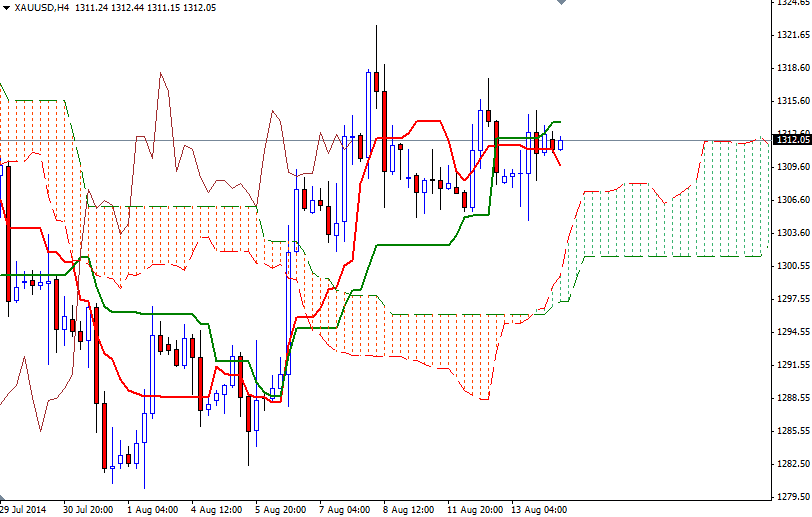

The XAU/USD pair has been range bound for the last five days but it appears that the bulls are determined to hold the market above the Ichimoku clouds on the daily time frame. Technically speaking, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. However, we still have a mixed outlook because of the bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on the daily and 4-hour charts.

If the bulls can build some steam and get a close above 1318, it is entirely possible that we will see the pair testing the next barrier at 1324.50. Beyond 1324.50, the real challenges will be waiting the bulls at the 1331.50 and 1340 levels. On the other hand, if the bears win the battle and drag prices below the 1303 support level, they will be targeting the 1297/2 area next.