The XAU/USD pair closed slightly higher than opening on Thursday after the weaker-than-anticipated economic data released from the Unite States raised doubt over how quickly the Fed is going to start to raise rates to normalize policy. Gold prices traded as low as $1319.20 an ounce before retreating back to the $1312 level. Lately, fears of an escalation of tensions between Ukraine and Russia have created a floor under the market but weighing on the yellow metal is the dominant up-trend in equities and lack of physical demand.

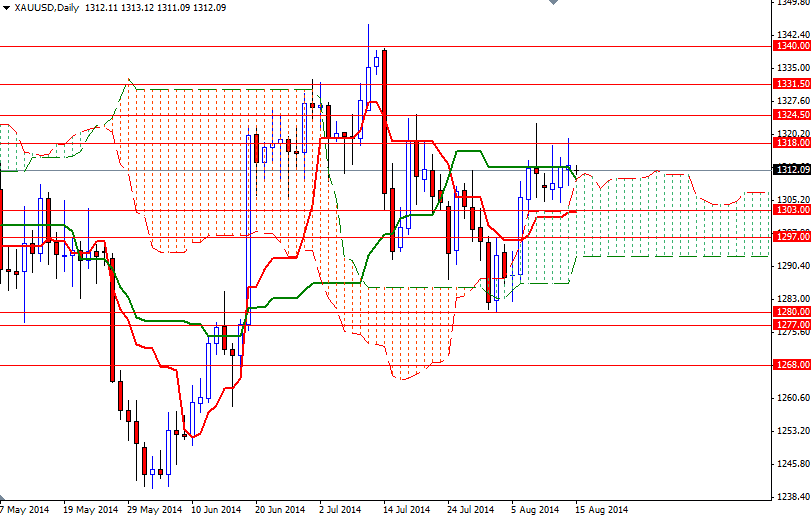

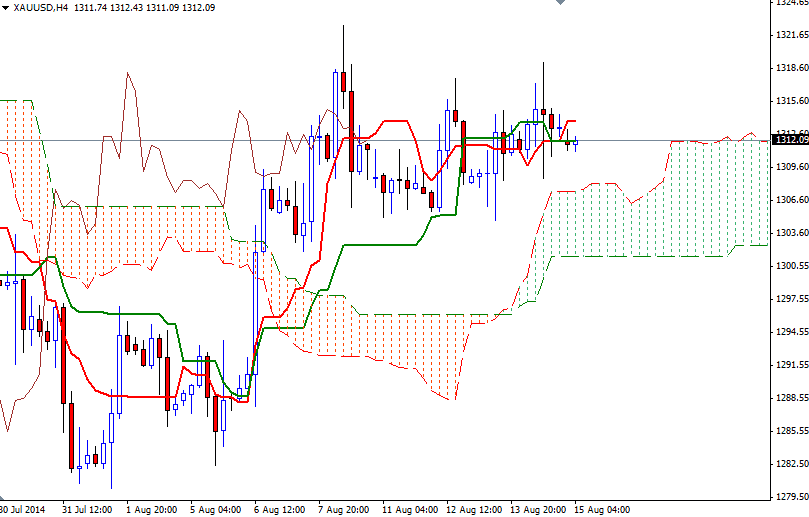

It seems that gold prices will keep oscillating around the 1312 level while the 1318/24 and 1303 levels contain the market. The bulls don’t want to give up and work hard to hold prices above the 1303 support level but the sellers come in and step up the pressure every time the market tries to rally.

The pattern on the charts suggests we are going to be range bound in the near term while the market simply has no real catalyst to push prices in either direction. Only a daily close above the 1318 level would lure some investors back to the market and increase the possibility of a bullish attempt to test the 1324.50 resistance level. Beyond that level, 1331.50 will be the key level for the bulls to pass in order to challenge the bears on the 1340 battle field. If the bears increase the downward pressure and capture the 1303 support level, the XAU/USD pair will probably test 1297. Breaching this support would indicate that the next stop will be the 1292 level.