The XAU/USD pair extended its losses on technical selling and growing perception that the U.S. Federal Reserve is looking to withdraw policies that have been in place for years. Breaking below the 1286 support level triggered a sell-off which gained momentum after the latest reports released from the Unite States came out better than anticipated. The Labor Department reported that first-time jobless claims fell to 298K from 312K and data released by the National Association of Realtors showed that sales of previously owned homes advanced to a 5.15 million annualized pace in July. The Philadelphia Fed's manufacturing index also was stronger than estimated.

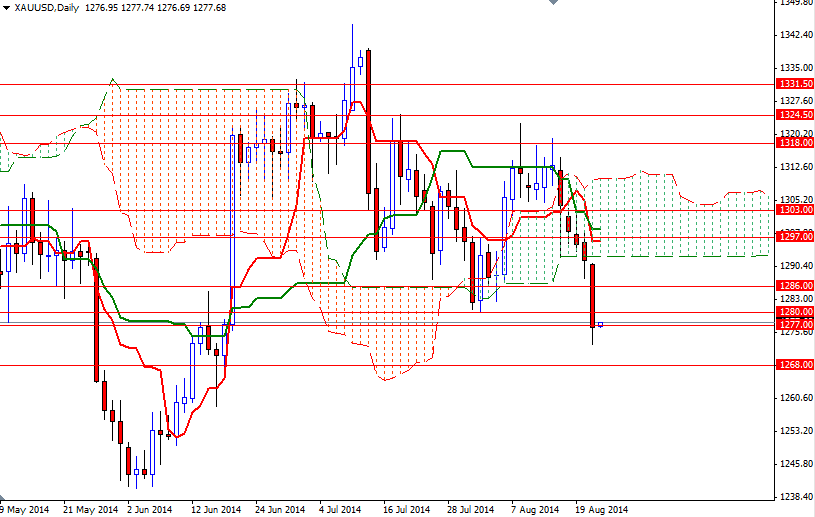

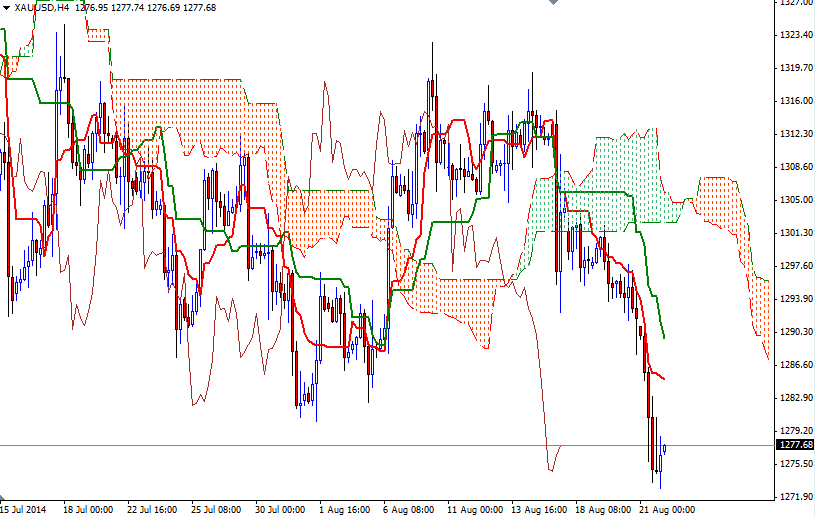

In my previous analysis, I had mentioned the importance of the 1287/6 support area and pointed out that it was technically possible to see a bearish continuation targeting the 1280/77 zone once that support collapsed. Although bearish technical formation on the daily and 4-hour charts suggest there is still more room for the pair to sink, we might encounter some support around the current levels. Currently, the XAU/USD pair is trying to hold above the 1277 level so I will be keeping an eye on the shorter time frames.

If the bulls return to the market and push prices higher, resistance can be found at 1280/2 and 1286/7. Closing above the 1286/7 resistance might give the bulls extra power they need to reach the bottom of the daily cloud which sits at 1292.70. However, if the bears continue to dominate the pair and keep prices below 1286, then the market will probably test the 1268/9.50 support level eventually. They have to capture that camp in order to test the 1260 and 1251 levels. Fed Chair Janet Yellen who speaks to global central bankers later today at may give us more clues on the outlook for interest rates.