Gold prices rose for a second straight session on Thursday to settle at their highest level in thirteen days as the conditions in the marketplace increased desire for safe haven diversification. Support from the heightened geopolitical tensions offset a better-than-expected reading on unemployment claims and helped the XAU/USD pair to bounce from the top of the Ichimoku clouds on the daily time frame. Some investors abandoned stocks and flocked to the gold market after Russia banned agriculture imports from the United States and European Union in response to Western sanctions and President Barack Obama authorized air strikes in Iraq.

It appears that fear factor came back into the market and that is increasing the demand for disaster insurance. Since the precious metal tends to gain during times of uncertainty, the major equity markets and USD/JPY pair will be on my radar. If stocks extended declines, gold prices may climb back above the $1312 level.

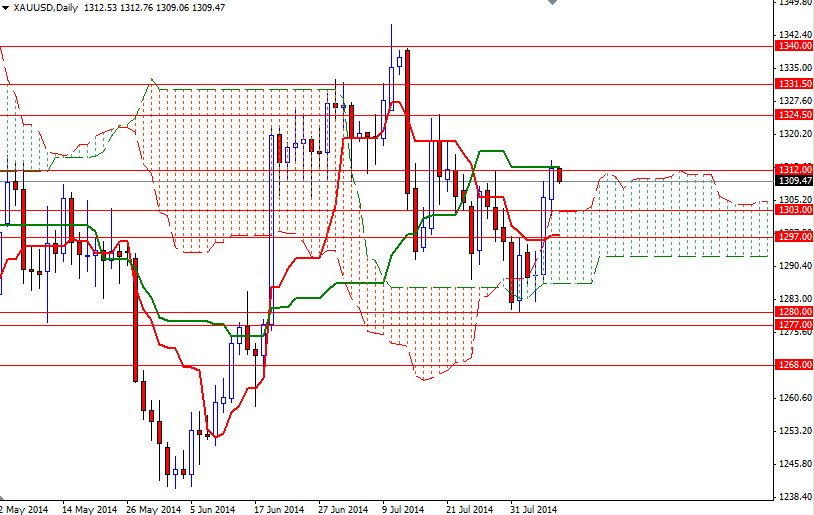

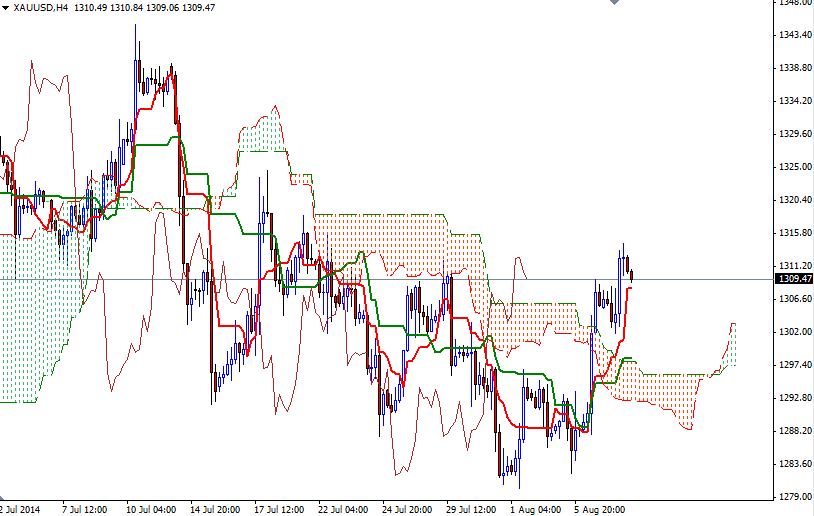

As I mentioned in yesterday's analysis, trading above the Ichimoku clouds on both the daily and 4-hour charts gives the bulls an advantage. Technical outlook suggests that there is more strength and volume behind the bulls at the moment. So until the market drops back below the clouds and we have a bearish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) cross, there will not be any real reason to sell. In the meantime, the key levels to watch will be 1312 and 1303. I think the pair has to push its way through the 1312/1312.64 area in order to start a journey towards the 1324.50 level. On its way up, expect to see some resistance at 1318. To the down side, there is an interim support between 1307 and 1303. Below that, an important challenge will be waiting the bears at 1297.