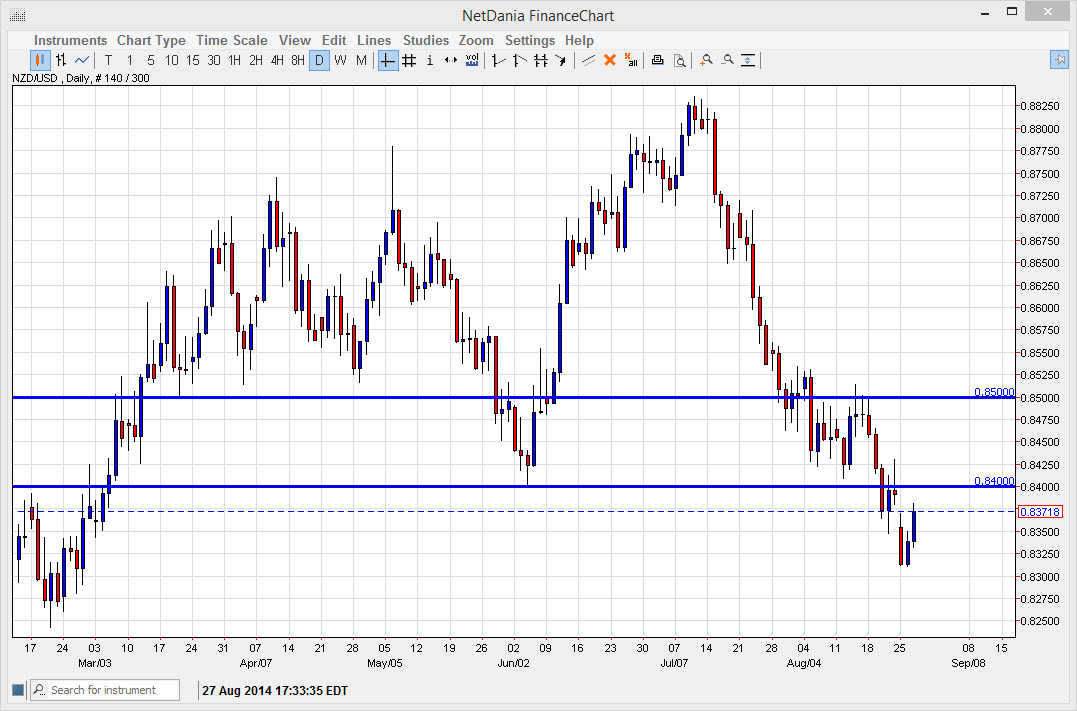

The NZD/USD pair rose during the course of the day on Wednesday, trying to fill the gap from the open on Monday. That being said though, we did close towards the top of the candle so it is a bit difficult to start selling right now. I will be looking to sell this contract though, because I believe that there is a significant amount of resistance between the 0.84 handle, and of the 0.85 handle. With that, I think that sooner or later I should see a nice selling opportunity, even if it happens to be on the short-term charts.

I do not have the resistive candle to sell quite yet, but it’s only a matter of time as far as I can see. The fact that we have a shooting star that is based on the 0.84 level, and as a result I believe that the selling pressure will continue to appear there. This being the case, I feel that the market is one that you cannot buy right now, because there are far too many things that can happen as far as I see causing the market to fall. In fact, there are a lot of potential geopolitical headlines that could have people buying the US dollar. Certainly, the problems in the Middle East and the Ukraine could have the markets flare up in a “risk off” type of situation at any moment.

That being the case, I am bearish but willing to change above the 0.85

I am bearish of this market, but I also recognize the fact that if we get above the 0.85 level, the market should then take off to the upside as it would show a significant breakdown of resistance, and that being the case the market should go much higher from there, perhaps going back into the previous consolidation area that extends all the way to the 0.88 level. However, I believe that’s less likely than finding the resistance that I’m looking for. Ultimately, I think that we could break down as low as 0.8250 once the sellers get back into the marketplace.