USD/JPY Signal Update

There are no outstanding signals.

Today’s USD/JPY Signal

Entries may only be made before 5pm New York time today, or within the following Tokyo session.

Risk 0.75% of equity.

Short Trade

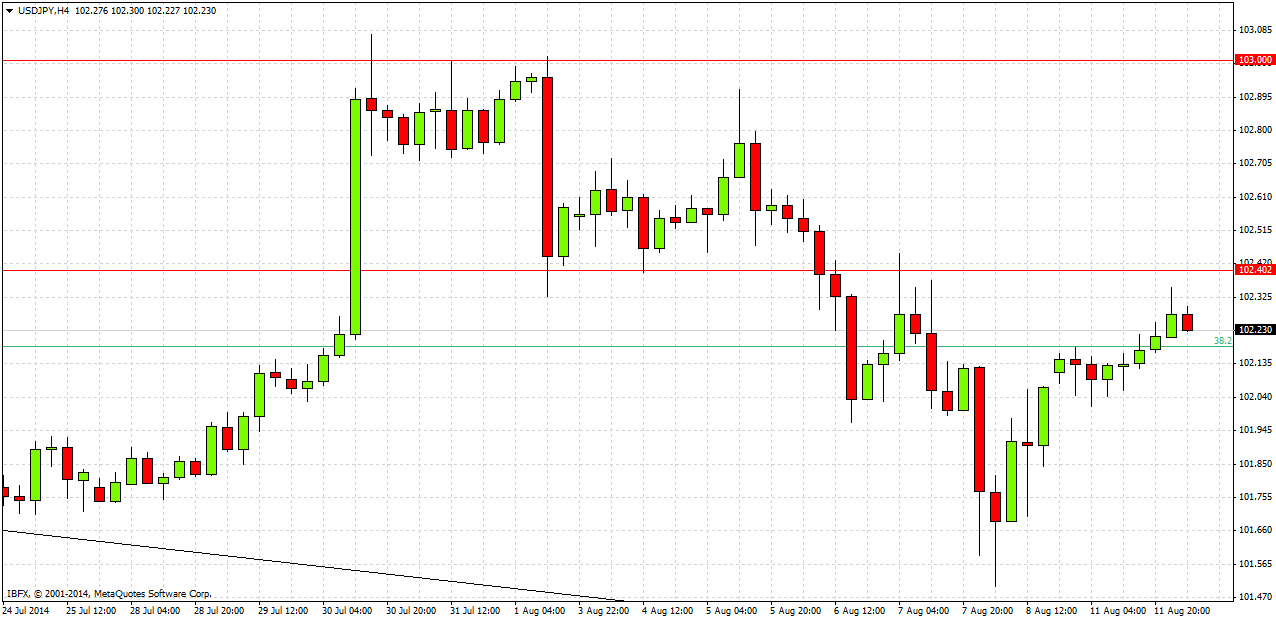

Short entry following bearish price action on the H1 time frame after the first touch of 102.40. Once an hourly candle closes above 102.50, the signal is invalidated.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 101.75.

Remove 75% of the position as profit at 101.75 and leave the remainder of the position to ride.

If the trade is in profit before the news release due at the beginning of the Tokyo session later, protect your trade to prevent loss.

USD/JPY Analysis

Since February, this pair has been ranging between around 100.75 and 103.00, with opportunities for profitable trades being restricted to trading that range. However within the range the pair has been respecting key flipped support and resistance levels, especially when they coincide with key round and/or psychological numbers. At the moment we are well within the range, but we have flipped support to likely resistance at around 102.40 – 102.50 which we are very close to at the time of writing. There could be a good opportunity for a short here, especially if we bounce off the key psychological level of 102.50 before the news due at the start of the Tokyo session. An open trade will need to be protected at that point.

There are no high-impact data releases due today concerning the USD. Regarding the JPY, there will be a release of the preliminary Japanese GDP figures at 12:50am London time. It will probably be a fairly quiet day today for this pair before that news release.