USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signal

Entries must be made before 5pm London time.

Risk 0.75% of equity.

Short Trade

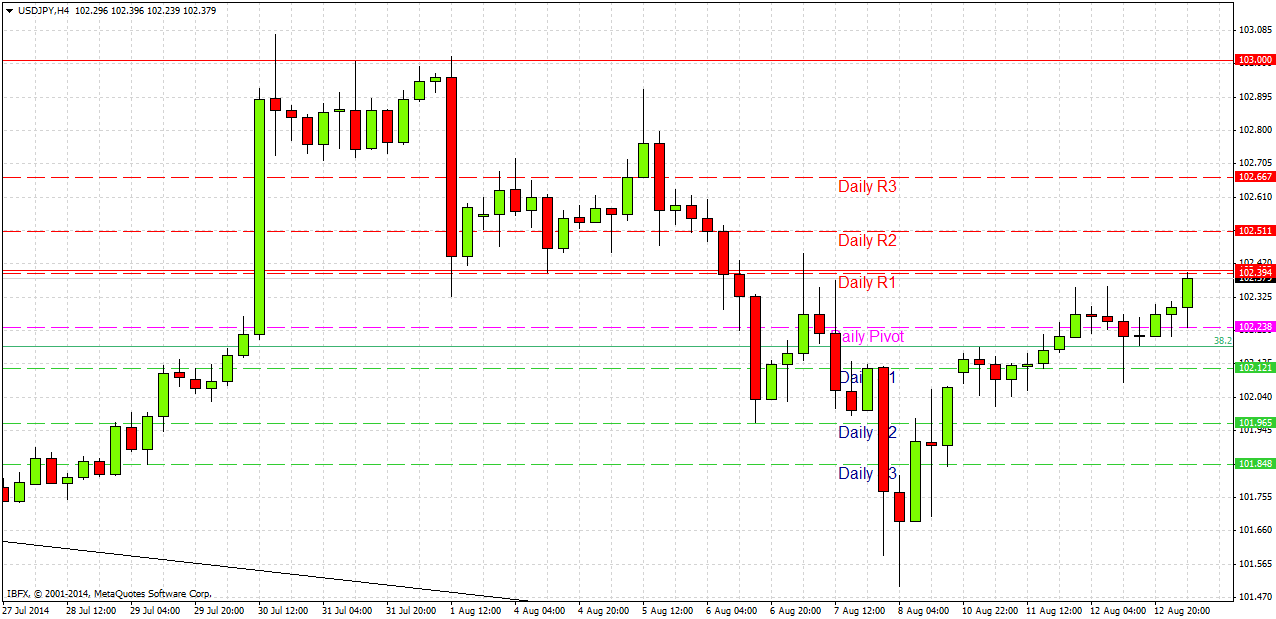

Go short following bearish price action on the H1 time frame after the first touch of 102.40. Once an hourly candle closes above 102.50, the signal is invalidated.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 101.75.

Take off 75% of the position as profit at 102.15 and leave the remainder of the position to run.

USD/JPY Analysis

At the time of writing just after the London Open, we are approaching the key resistance area from 102.40 to 102.50. This is a good place to look for a short trade but it will be worthwhile to be extremely cautious, as the daily chart is suggestive of bullishness and a continuing move up to 103.00. As soon as an H1 candlestick closes above 102.50, it will be best to forget about a short trade. However if the price does stall at 102.40-102.50 and prints some very bearish price action, a short becomes a logical option. It would be a good idea to protect any trade that is in profit before the US news releases due half an hour after the New York open.

There are no high-impact data releases due today concerning the JPY. Regarding the USD, there are Retail Sales data due at 1:30pm London time. Therefore it is likely that we will have a quiet London session before New York opens, when things should get livelier.