USD/JPY Signal Update

Yesterday’s signal’s entry level was reached, but the price action was not “very bearish” so the trade should not have been taken.

Today’s USD/JPY Signal

Entries must be made before 5pm New York time, or during the following Tokyo session.

Risk 0.75% of equity.

Short Trade

Short trade following bearish price action on the H1 time frame after the first touch of 103.00. Once an hourly candle closes above that level, the signal is invalidated.

Place a stop loss 1 pip above the local swing high.

Adjust the stop loss to break even when the price reaches 102.60.

Remove 50% of the position as profit at 102.60 and leave the remainder of the position to ride.

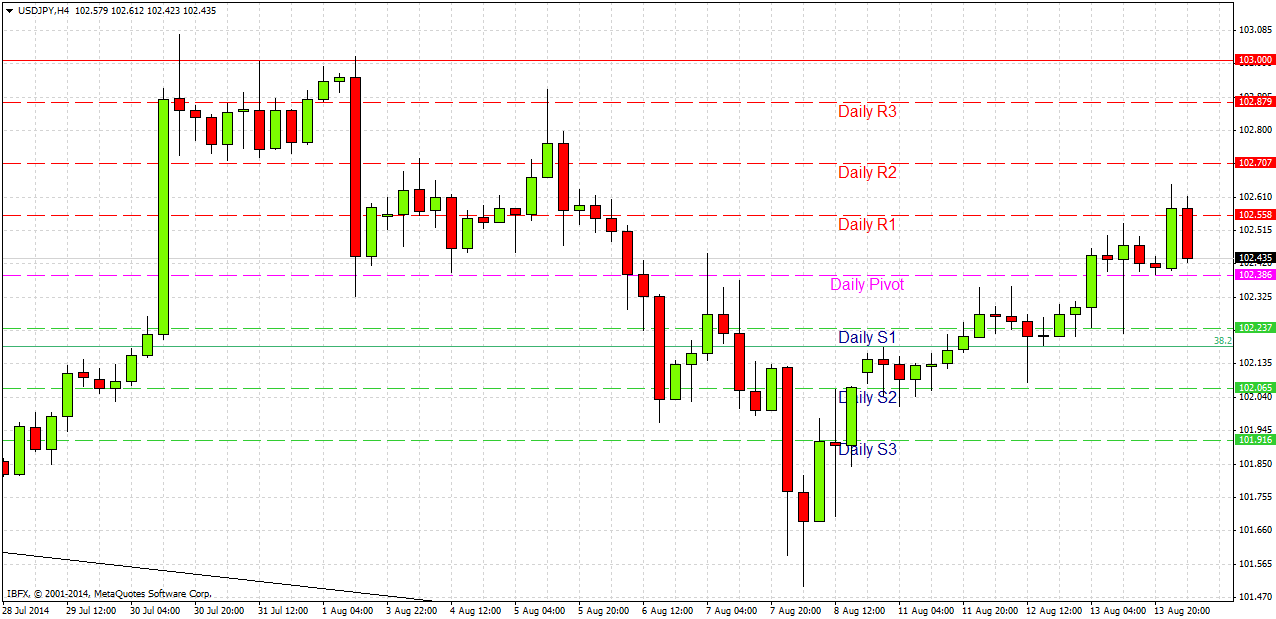

USD/JPY Analysis

As expected yesterday, the price did move upwards after initially stalling at the likely resistance I had identified at the 102.40 – 102.50 zone. The H1 candles were very small before the news and did not show a really strong rejection of the level, and so were not signalling a good short. Paying attention to the picture on the daily time frame pays off in cases such as this.

The area at around 102.50 seems to have lost most of its significance, so the only level we have to work with in today’s picture is likely resistance at 103.00.

The daily chart suggests we will now continue upwards to 103.00.

There are no high-impact data releases due today concerning the JPY. Regarding the USD, there are Unemployment Claims data due at 1:30pm London time. Therefore it is likely that we will have a quiet London session before New York opens, when things should get livelier.