USD/JPY Signal Update

Last Thursday’s signal expired without being triggered.

Today’s USD/JPY Signal

Entries are only to be made before 5pm New York time, or during the following Tokyo session.

Risk 0.75% of equity.

Short Trade

Go short following bearish price action on the H1 time frame after the first touch of 103.00.

Put a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 102.66.

Take off 50% of the position as profit at 102.66 and leave the remainder of the position to run.

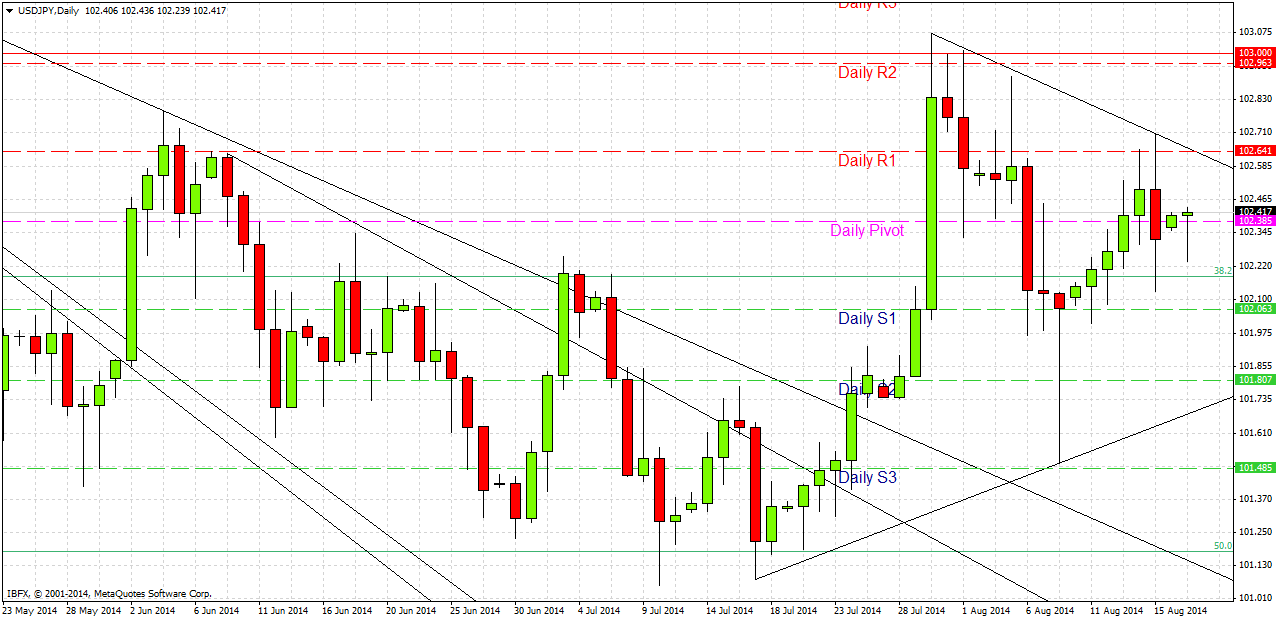

USD/JPY Analysis

This pair is beginning to form a consolidating triangle. Unfortunately, both of the trend lines of this triangle are well within the long-term consolidation zone that runs from 103.00 down to about 100.50, so its significance is probably limited.

Recent price action has suggested a slight bullish bias, but in addition to the bullish pin bar we had a few days ago on the daily chart followed by a succession of higher lows, we also have had a succession of lower highs above.

The only likely high-probability trade approaching would be a short confirmed by price action from the 103.00 level.

Some local support below us at the time of writing has formed at the 38.2% Fibonacci retracement level of the long-term upwards move, at 102.19, but I would not recommend any long trades off that point.

There are no high-impact data releases due today concerning either the JPY or the USD. Therefore it is likely to be a very quiet day today.